Estate Baron Adds White Label Option

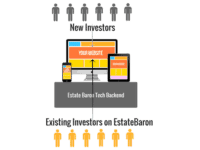

Estate Baron, a Melbourne-based crowdfunding startup, has announced an initiative to allow property developers the ability to crowdfund their property development projects online by using the Estate Baron platform as a white label service. Estate Baron co-founder, Moresh Kokane, says that the concept will provide… Read More

Read more in: Investment Platforms and Marketplaces, Global, Real Estate | Tagged australia, estate baron, Moresh Kokane, white label