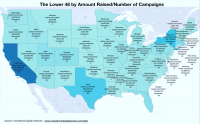

Capital Ideas: Can $12K Beat Wall Street? Paul Lovejoy’s 366-Day Crowdfunding Challenge Says Yes

Crowdfunding a New Path to Wealth: Paul Lovejoy’s Leap Year Portfolio and the Fight for Investor Access Paul Lovejoy, founder of Stakeholder Enterprise, shared his bold vision for democratizing wealth creation. His ambitious “Leap Year Portfolio” experiment—making 366 crowd-based investments in 366 days—offers a compelling… Read More

Read more in: Strategy, Opinion | Tagged capital ideas, dara albright, groundfloor, ican, jobs act, mark hiraide, nick morgan, paul lovejoy, perspective, reg a, reg cf, reg d, sec