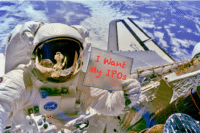

Bitgo Trades up on NYSE Debut

BitGo (NYSE:BTGO) has caught a bid on the first day of trading on the New York Stock Exchange. BitGo priced its shares at $18 each, valuing the company at approximately $2.08 billion. The offering raised over $212 million, with most proceeds going to selling shareholders…. Read More

Read more in: Blockchain & Digital Assets, Investment Platforms and Marketplaces, Offerings | Tagged bitgo, ipo, nyse