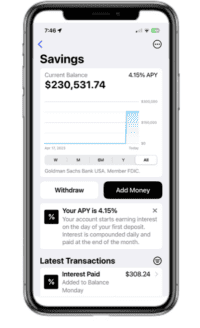

Apple Card Holders Now Number Over 12 Million, Increases Savings Rate to 4.5%, Deposits Over $10 Billion

Apple (NASDAQ:AAPL) has revealed that the number of Apple Card holders now numbers over 12 million since its launch in 2019. Apple partners with Goldman Sachs (NYSE:GS) to provide the Fintech services. At the same time, in the past several days, Apple moved its Apple… Read More

Read more in: Fintech, Featured Headlines | Tagged apple, apple card, banking, bill johnson, goldman, goldman sachs, jennifer bailey