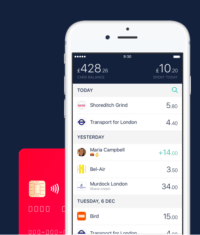

Ant Group Announces Additional Investment in Singapore based ANEXT Bank

Alibaba’s Ant Group has reportedly committed another SGD 200 million investment into ANEXT Bank, which is its wholly-owned subsidiary and SME digital bank. This, according to media reports from March 25, 2024. As reported by DealStreetAsia, the digital finance and technology firm had previously committed… Read More

Read more in: Asia, Fintech | Tagged anext bank, ant group, banking, digital bank, singapore, southeast asia