Changes at the Consumer Financial Protection Bureau: Acting Director Mulvaney Calls for Review

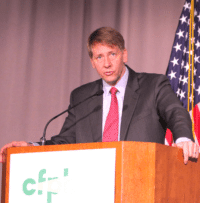

The passing of the baton from former Consumer Financial Protection Bureau (CFPB) Director Richard Cordray to acting Director Mick Mulvaney was rife with confusion and questions all driven by parochial politics. In a snub to the President’s prerogative of appointing a new Director, Cordray decided to… Read More

Read more in: Politics, Legal & Regulation, Opinion | Tagged cfpb, consumer financial protection bureau, mick mulvaney, payday, perspective, richard cordray