The Consumer Financial Protection Bureau (CFPB) announced a new rule to ban financial companies from using mandatory arbitration clauses. The CFPB said these rules have denied people their day in court. Many consumer financial products like credit cards and bank accounts have arbitration clauses in their contracts that can prevent consumers from joining together to sue their bank or financial company for wrongdoing. The CFBP said that by forcing consumers to give up or go it alone – usually over small amounts companies can sidestep the court system, avoid big refunds, and continue harmful practices.

The Consumer Financial Protection Bureau (CFPB) announced a new rule to ban financial companies from using mandatory arbitration clauses. The CFPB said these rules have denied people their day in court. Many consumer financial products like credit cards and bank accounts have arbitration clauses in their contracts that can prevent consumers from joining together to sue their bank or financial company for wrongdoing. The CFBP said that by forcing consumers to give up or go it alone – usually over small amounts companies can sidestep the court system, avoid big refunds, and continue harmful practices.

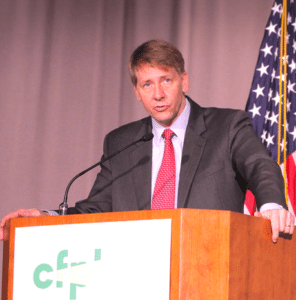

“Arbitration clauses in contracts for products like bank accounts and credit cards make it nearly impossible for people to take companies to court when things go wrong,” said CFPB Director Richard Cordray. “These clauses allow companies to avoid accountability by blocking group lawsuits and forcing people to go it alone or give up. Our new rule will stop companies from sidestepping the courts and ensure that people who are harmed together can take action together.”

But while the CFPB said their ruling would better protect consumers the ruling generated a good amount of criticism. Some observers said the CFPB ruling would simply line the pockets of class action attorneys;

“This regressive attack on freedom of contract transfers wealth from consumers to wealthy attorneys,” said Ted Frank, director of CEI’s Center for Class Action Fairness.

CEI submitted public comments to the CFPB last year raising serious concerns about the rule. Instead of a ban on arbitration, CEI said the CFPB could take other steps to help consumers, such as making the terms of arbitration clauses opt-out.

CEI submitted public comments to the CFPB last year raising serious concerns about the rule. Instead of a ban on arbitration, CEI said the CFPB could take other steps to help consumers, such as making the terms of arbitration clauses opt-out.

“The CFPB has disregarded vast data showing that arbitration more often compensates consumers for damages faster and grants them larger awards than do class action lawsuits. This regulation could have particularly harmful effects on Fintech innovations, such as peer-to-peer lending,” said John Berlau, CEI senior fellow.

Richard Gottlieb, Partner in the Financial Services area at the Law Firm Manatt, posted earlier today;

“The CFPB claims to have conducted “the most comprehensive study of mandatory arbitration clauses ever undertaken,” but numerous industry groups have rejected its conclusions, relying in part on the very findings on which the CFPB likewise relies.”

Jeb Hensarling, the Chairman of the House Financial Services Committee, issued the following statement on the CFPB arbitration rule;

“This bureaucratic rule will harm American consumers but thrill class action trial attorneys. In releasing this rule today, Director Cordray ignored a prior request by the acting Comptroller of the Currency that he work with the OCC to resolve its potential safety and soundness concerns. As a matter of principle, policy, and process, this anti-consumer rule should be thoroughly rejected by Congress under the Congressional Review Act. In the last election, the American people voted to drain the D.C. swamp of capricious, unaccountable bureaucrats who wish to control their lives. Congress must work with President Trump to make good on this mandate by fundamentally reforming the CFPB and dismantling the Administrative State.”

The decision by the CFPB has generated concern the new rule will fuel renewed interest in class action lawsuits clogging the courts with specious legal actions which are frequently of little benefit to consumers.

The decision by the CFPB has generated concern the new rule will fuel renewed interest in class action lawsuits clogging the courts with specious legal actions which are frequently of little benefit to consumers.

One thing is certain, all financial services firms will be huddling with their counsel to adjust to the new rules.

The Final rule, which will become effective 60 days after publication in the Federal Register, is a mere 775 pages long.