Mambu is a Software as a Service (SaaS) platform that has quickly differentiated its product as a leader in the white label core banking space. The cloud based service provides a path for both traditional finance and Fintech’s to rapidly launch a digitally native financial services platform without diving into the hassle of a custom, in house solution in the highly regulated finance industry.

Today, Mambu is operating in 45 different countries indicating its ability to quickly adapt to diverse regulatory regimes. Launched in 2009, Mambu saw an opportunity to fill the vast void that legacy technology was simply unable to accomplish given the rise of alternative finance.

Mambu is a Fintech rockstar that started small but is quickly becoming bigger. Co-founded by CEO Eugene Danilkis and COO Frederik Pfisterer, and Sofia Nunes, Head of Talent & Culture, Mambu is a Berlin based Fintech, a standout in the emerging Fintech scene. Danilkis started his career developing NASA-certified software for the International Space Station. Today, he leads an international team which is helping banking and Fintech companies adapt to the future of finance.

Crowdfund Insider recently connected with Danilkis for an update on platform progress. Our discussion is below.

Can you please provide an update on Mambu and global utilization? How many different companies are using your digital banking services? Which countries are you operating in?

Eugene Danilkis: Mambu is growing fast, both in terms of volume of clients and the diversity of our client base. We have more than 180 live operations in over 45 countries, our solution powers over 5000 loan and deposit products which serve over 4 million end customers. Those products include business financing, consumer lending, marketplace lending, current accounts, transactional accounts and savings accounts.

Mambu is live on 6 continents, countries of operation include the UK, Netherlands, Germany, Sweden, the US, Kenya, Australia, Philippines, China and Argentina, to name a few. Our clients range from FinTech revolutionaries to traditional banks. Some examples include:

Mambu is live on 6 continents, countries of operation include the UK, Netherlands, Germany, Sweden, the US, Kenya, Australia, Philippines, China and Argentina, to name a few. Our clients range from FinTech revolutionaries to traditional banks. Some examples include:

- Oaknorth, the bank built by entrepreneurs for entrepreneurs, which provides business loan and deposit products for UK SMEs. It is the the first fully regulated European cloud-based bank, has a loan book of over £600m and has just achieved unicorn status having been valued at over 1 billion US dollars.

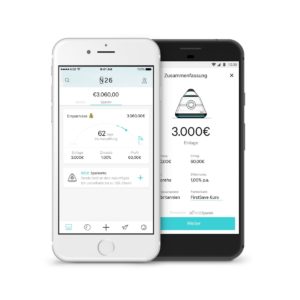

- N26, Europe’s first mobile-only retail bank has more than 500,000 customers in 17 countries. It is one of the fastest growing mobile banks in the world and is headquartered in Berlin, Germany.

- New10, ABN AMRO’s newly launched SME lending Fintech, went from concept to launch in 10 months and is offering a fast and fully digital loan application process for Dutch businesses.

- Globe Telecom’s lending business Fuse, offers consumer and business lending products in the Philippines. By diversifying into financial services, leading Filipino telco Globe is able to offer more products to its 60 million customers.

- PayU Colombia is using Mambu to power its new short term deferred payment product. The product is currently being piloted in Colombia, with the potential for a wide scale roll out across Latin America.

Is online lending, including P2P, marketplace and balance sheet lending, the most demanded service right now?

Eugene Danilkis: Across all lending verticals, consumer, business and marketplace, there is significant demand for digital and customer centric loan products. New technology, like Mambu, has enabled providers to meet this need which would historically have been unviable due to the constraints of legacy systems. The products they are now able to provide are better tailored to consumer demands, regulatory requirements and market needs. Consumers and businesses seeking credit are benefitting from more choice and better products as a result of this shift.

That being said, we have experienced a rise in demand from institutions looking to launch new digital banking services, offering both deposit and loan products. A range of providers, from traditional banks to innovative startups are seeking to leverage the speed to market and agility of technology like Mambu to launch new products, expand into new markets, start new ventures and transform existing operations.

That being said, we have experienced a rise in demand from institutions looking to launch new digital banking services, offering both deposit and loan products. A range of providers, from traditional banks to innovative startups are seeking to leverage the speed to market and agility of technology like Mambu to launch new products, expand into new markets, start new ventures and transform existing operations.

We’ve also seen a growth in institutions looking to explore a different approach and take a marketplace model similar to that of N26. They want to collaborate with product providers to offer clients a wider range of products and services.

Where do you see the most opportunity for growth going forward the next 12 to 24 months?

Eugene Danilkis: We are seeing a growing trend of established financial institutions looking to launch their own FinTech or digital bank. It’s a concept we refer to as ‘launching speedboats from cruise ships’. These spin offs combine the best of two worlds, the resources and experience of an incumbent with the technology and culture of a FinTech. By operating independently these spin offs are able deliver significant results in a short period of time, free of the legacy technology and thinking which often anchors their parent organisations.

An example of this is New10, ABN AMRO’s newly launched Fintech, which provides fast and fully digital loan loans to Dutch SMEs. New10 went from concept to launch in 10 months with the Mambu implementation taking just four months. Operating independently, New10 is unencumbered by traditional processes and systems, which allows them to move quickly, innovate while still being able to access the extensive experience available within the bank.

We have a number of other similar initiatives in our pipeline and we expect to this demand continuing to increase in the next 12 to 24 months.

[clickToTweet tweet=”New10 went from concept to launch in 10 months with the Mambu implementation taking just four months #Fintech” quote=”New10 went from concept to launch in 10 months with the Mambu implementation taking just four months #Fintech”]

There appears to be more traditional lenders (IE banks) more inclined to go it alone and launch their own platforms. Goldman Sachs launched Marcus which they developed in house. Is this a trend? Or an opportunity for Mambu?

Eugene Danilkis: As mentioned above, this is a trend that is gathering momentum and it is an opportunity for Mambu. This approach allows banks to attract new customers whilst simultaneously enhancing their product offering for their existing customer base. Additionally, banks launching spinoffs can apply new technology and operational models to new markets by leveraging the best available technology. They can then take these learnings and apply it back to the larger bank.

As a result of this approach, we see demand growing for SaaS engines like Mambu. Incumbent institutions are taking inspiration from Fintechs like N26. The business model adopted by N26 has delivered, their customer base has grown by over 500% in a year and they now operate in 17 countries. Incumbents seeking to emulate this lean and agile approach are seeking out technology with the same attributes to drive their spin off initiatives.

What about other types of securities? Have you considered the ICO market? What about cryptocurrencies? Are you facilitating BTC, ETH etc?

Eugene Danilkis: One of our clients, a US-based lender, provides these services and utilises Mambu to allow holders of blockchain assets to leverage their holdings as collateral for cash loans. It is the first asset-backed lending platform to give blockchain asset holders access to liquidity without having to sell their tokens, basically traditional lending secured by non-traditional collateral. It is broadening blockchain technology’s reach by acknowledging financial wealth which is not readily accepted by traditional lenders.

And what about Blockchain? It seems like every bank in the world is moving to leverage Distributed Ledger Technology. Where is Mambu in this regards?

And what about Blockchain? It seems like every bank in the world is moving to leverage Distributed Ledger Technology. Where is Mambu in this regards?

Eugene Danilkis: We strongly believe in providing functionality and technology that brings fundamental value to our clients. At this point in time, we see blockchain adding value only when it is distributed, i.e. the ledger is shared across multiple entities, which can validate the transaction before it ends-up in the blockchain itself. In context of where Mambu operates, which is servicing a single entity, such capability wouldn’t add any significant value to our clients in and of itself, hence we are watching this closely, but not planning to introduce it in a near term.

We do expect more of our clients to use blockchain technology in combination with cryptocurrencies and smart contracts while partnering with other third parties, and we can readily support these uses cases and their easy integration with Mambu.

[clickToTweet tweet=”We do expect more of our clients to use #blockchain tech in combination with cryptocurrencies and smart contracts ” quote=”We do expect more of our clients to use #blockchain tech in combination with cryptocurrencies and smart contracts “]

What about the regulatory side of things? Are you encountering significant hurdles in any region? Your platform is compliant in all markets – correct?

Eugene Danilkis: We are seeing more regulators encouraging SaaS implementations, even in highly regulated markets like the UK, US and Germany. Regulators have taken a consultative approach and are working with different lenders and reviewing environments in order to understand it better. They see the benefit of SaaS and in an effort to increase competition and bring more consumers into the financial sector, are allowing more new entrants to be cloud-based.

We have the right internal controls and work with preferred suppliers like AWS on the data side to ensure we are compliant. Mambu’s APIs allow a lot of flexibility in automating regulatory compliance directives, setting up alerts for certain events or automating previously manually processes like reporting.

You have an office in the US – how is reception of Mambu SaaS in the states?

Eugene Danilkis: We are fairly new to the US but reception has been good so far. There is an increasing demand for SaaS platforms and we are talking to a broad range of providers, from new banking and lending entrants keen to do something different, together with traditional top tier institutions looking to launch new products or expand their product offering. Our offices in Miami support the US and Canadian market as well as our growing customer base in Central and Latin America.

Cybersecurity has been a hot topic of late with the recent intrusions including the US SEC. What is Mambu doing to guard against attacks and hacks?

Eugene Danilkis: We operate in a highly sensitive and regulated environment (i.e. financial services) and this requires us to consider security as a critical aspect of our operations. Security is embedded in every area of the organisation, starting with physical access and ensuring security of the workplace and devices, and further in every step of application lifecycle management. We employ industry best practices to ensure security is part of our development lifecycle from the definition of requirement, to peer reviews, to continuous automated security testing and vulnerabilities scanning. In addition, we partner with multiple third party organisations and recognised security experts to perform periodic testing of our platform and the corresponding infrastructure.