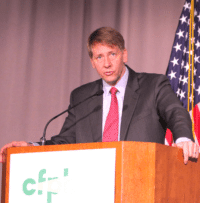

Karen Mills, Harvard: Regulate, But Allow Online Lending Market Space to Innovate

Senior Fellow at Harvard Business School Karen Gordon Mills along with VP of Strategy at Fundera, Brayden McCarthy, have recently posted a working paper on SME lending. Mills is also the former Administrator of the Small Business Administration – a post she held during the Obama administration just… Read More

Read more in: General News, Featured Headlines, Fintech, Investment Platforms and Marketplaces, Politics, Legal & Regulation | Tagged banks, brayden mcCarthy, cfpb, fdic, fed, ftc, harvard business school, karen mills, marketplace lending, regulation, sec, small businesses