The Consumer Financial Protection Bureau (CFPB) has ordered LendUp to pay approximately $1.83 million in refunds and pay a civil penalty of $1.8 million. The enforcement action was taken as the “online lender did not help consumers build credit or access cheaper loans” as the company claimed. The refunds were said to impact over 50,000 LendUp customers. The action was taken simultaneously as the California Department of Business Oversight assessed a settlement with LendUp of $2.7 million. The California action found a total of 385,050 individual violations of two laws.

The Consumer Financial Protection Bureau (CFPB) has ordered LendUp to pay approximately $1.83 million in refunds and pay a civil penalty of $1.8 million. The enforcement action was taken as the “online lender did not help consumers build credit or access cheaper loans” as the company claimed. The refunds were said to impact over 50,000 LendUp customers. The action was taken simultaneously as the California Department of Business Oversight assessed a settlement with LendUp of $2.7 million. The California action found a total of 385,050 individual violations of two laws.

The home page of LendUp states today;

“Join the hundreds of thousands of LendUp customers moving beyond their credit history — and into a brighter future.”

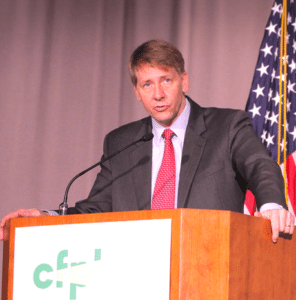

Richard Cordray, CFPB Director, explained that LendUp pitched itself as “consumer-friendly” and as an alternative to traditional payday lenders. But apparently, LendUp did not pay attention to the consumer financial laws;

“The CFPB supports innovation in the fintech space, but start-ups are just like established companies in that they must treat consumers fairly and comply with the law.”

San Francisco-based parent company Flurish, doing business as (DBA) LendUp, is said to have offered single payment loans and installment loans in 24 different states. LendUp marketed itself as a way for consumers to build credit, improve credit scores and gain access to less expensive credit. The CFPB said the online lender did not live up to is promises. Reportedly some of its credit products weren’t available to consumers as they were advertised. The company was also said to not properly furnish information to the credit reporting companies, denying consumers the promised opportunity to improve their creditworthiness. The CFPB stated that LendUp’s conduct violated multiple federal consumer financial protection laws, including the Truth in Lending Act and the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Some of the specific transgressions included not presenting consumers with a transparent annual percentage rate (APR). LendUp also reversed pricing without the consumer knowledge. The CFPB said one particular product allowed borrowers the ability to choose an earlier payment date. If they selected this option they would receive a discount on the origination fee. But if the consumer later extended the repayment date the company would reverse the discount without notification. If a borrower defaulted on a loan, any discount received at origination was reversed and added to the amount sent to collections.End deceptive loan practices: LendUp must stop misrepresenting the benefits of borrowing from the company, including what loan products are available to consumers and whether the loans will be reported to credit reporting companies. The company must also stop mispresenting what fees are charged, and it must include the correct finance charge and annual percentage rate in its disclosures.

LendUp is required to end deceptive loan practices, The online lender must stop misrepresenting the benefits of borrowing from the company, including what loan products are available to consumers and whether the loans will be reported to credit reporting companies. The company must also stop mispresenting what fees are charged, and it must include the correct finance charge and annual percentage rate in its disclosures.End unlawful advertisements: The company must regularly review all of its marketing material to ensure it is not misleading consumers.

The CFPB has been focusing additional scrutiny on the online lending industry with greater attention being paid to platforms that may be described as Payday loan sites.