Assetz Capital Reveals that Typical Capital Raise, even During COVID, Hasn’t Been Significantly Impacted

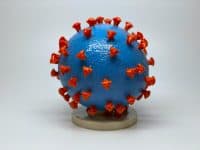

UK-based Assetz Capital, a peer-to-peer lender that originates secured loans, notes that even during the COVID-19 pandemic, typical capital raise has not been impacted in a “seemingly” large way. According to a blog post from Assetz Capital, businesses are currently looking for funding and there… Read More

Read more in: Global, Investment Platforms and Marketplaces, Real Estate, Strategy | Tagged alternative lender, alternative lending, assetz capital, coronavirus, covid-19, europe, p2p lender, p2p lending, peer to peer, property market, small businesses, smbs, sme's, uk, united kingdom