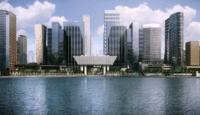

Enhanced Real Estate Services Introduced by ADGM’s Registration Authority to Support Regional Investors

Abu Dhabi Global Market (ADGM), the international financial centre in the UAE capital, has taken another significant step forward in supporting its real estate sector. Through its Registration Authority (RA), ADGM recently announced a new integrated suite of real estate services, building upon the comprehensive… Read More

Read more in: Asia, Real Estate | Tagged abu dhabi, adgm, middle east, real estate, uae