In 2019, the Monetary Authority of Singapore (MAS) launched a consultation on the Payment Services Act (PS Act) that in relation to AML/CFT, and other amendments in respect of digital payment token (DPT) service and certain technical amendments. The consultation address certain proposed amendments to the Act. The initiative was largely aligned with tbhe Financial Action Task Force (FATF) and its requirements for crypto including the “travel rule” that demands virtual asset service providers (VASPs) to maintain transaction records for both buyers and sellers of digital assets.

Published today, MAS is sharing its responses to the consultation.

The PS Act requires a person that carries on a business of providing any payment service in Singapore, including a DPT service, to be licensed.Each payment service provider needs to hold just one of the three possible licences:

(i) Money- Changing licence;

(ii) Standard Payment Institution licence; or

(iii) Major Payment Institution licence.

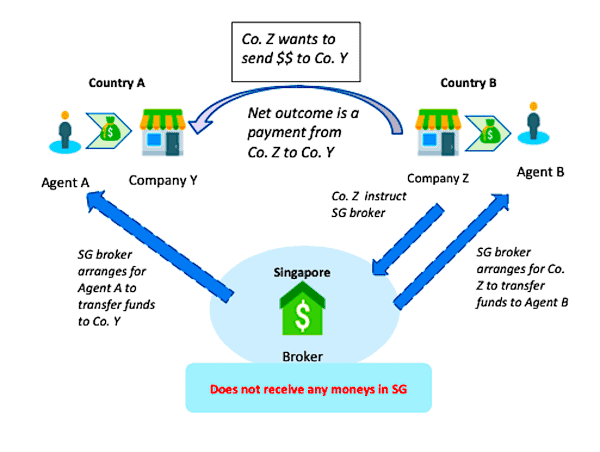

MAS states that any service of accepting DPTs from one DPT account for the purposes of transmitting or arranging for the transmission of, the DPTs to another DPT account will be regulated. The proposed amendments to the PS Act will capture entities that are providing transfer of DPTs as a service, regardless of where the DPT service provider locates its computing or operating systems including for keeping its accounts and transaction records.

The consultation response is available below.