Upside Saving, a UK-based open-banking-marketing-platform connects Brands with consumers by offering frictionless cashback, is set to close its equity crowdfunding campaign on Seedrs with more than £330,000 raised. The funding round was launched earlier this month and has attracted over 315 Seedrs investors.

Upside Saving, a UK-based open-banking-marketing-platform connects Brands with consumers by offering frictionless cashback, is set to close its equity crowdfunding campaign on Seedrs with more than £330,000 raised. The funding round was launched earlier this month and has attracted over 315 Seedrs investors.

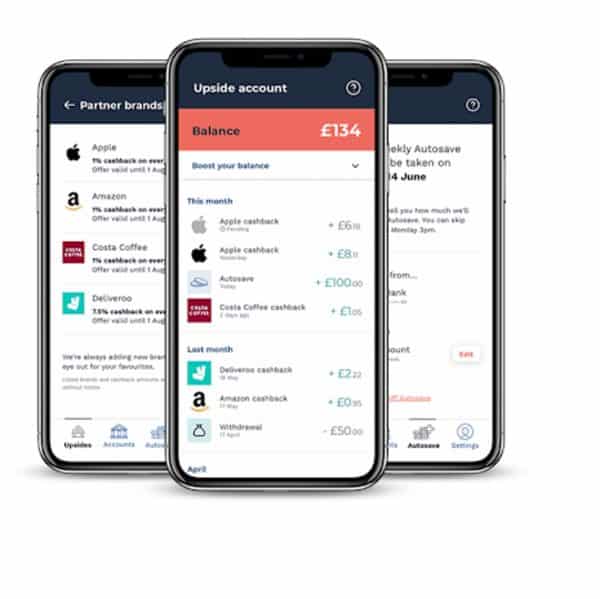

As previously reported, Upside Saving is using open banking and AI to help customers automate their savings. The company noted that its platform connects retailers with consumers in a “relevant and rewarding way” by offering frictionless cashback. Retails then help consumers build up emergency savings in their time of need while driving incremental sales. How it works:

“Automated savings that grow as users spend: Upside enables customers to automatically start saving by harvesting upside from their everyday spending, without compromising their lifestyle. With the potential to accumulate hundreds of Pounds a year.”

Upside Saving also noted its business model is aligned with the end customer.

“We make money, when we find money for the customer. Practically, we will take a commission of all the ‘upside’ found on behalf of customers.”

Funds from the Seedrs campaign will be used to continue the growth and development of the Upside Saving’s platform. Upside Saving is now offering 6.72% in equity at a £4.3 million pre-money valuation through the campaign.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!