Upside Saving, a UK-based open-banking-marketing-platform connects Brands with consumers by offering frictionless cashback, has successfully secured its initial £300,000 funding target on equity crowdfunding platform Seedrs. Upside Saving’s campaign has already attracted more than 200 Seedrs investors.

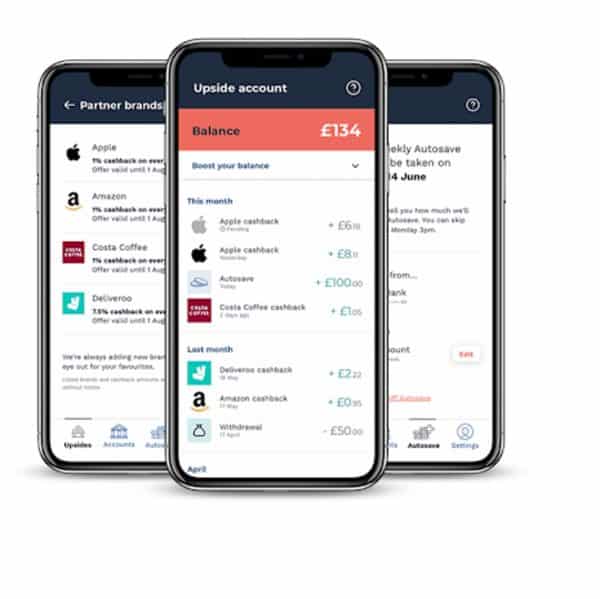

Founded in earlier this year, Upside Saving is using open banking and AI to help customers automate their savings. The company noted that its platform connects retailers with consumers in a “relevant and rewarding way” by offering frictionless cashback. Retails then help consumers build up emergency savings in their time of need while driving incremental sales. How it works:

“Automated savings that grow as users spend: Upside enables customers to automatically start saving by harvesting upside from their everyday spending, without compromising their lifestyle. With the potential to accumulate hundreds of Pounds a year.”

Upside Saving also noted:

“Our business model is aligned with the end customer: we make money, when we find money for the customer. Practically, we will take a commission of all the ‘upside’ found on behalf of customers.”

Funds from the Seedrs campaign will be used to continue the growth and development of the Upside Saving’s platform. Upside Saving is now offering 6.72% in equity at a £4.3 million pre-money valuation through the campaign, which is set to close at the end of October.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!