The growth of Fintech has slowed in Switzerland but simultaneously, the sector is maturing and showing signs that Fintechs are “beginning to outpace the [traditidional[ financial companies,” according to the IFZ Fintech Study 2020 from the Lucerne University of Applied Sciences and Art.

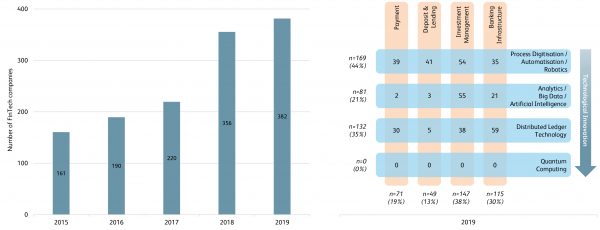

The report released last week claims that a record number of 382 Fintechs are incorporated in Switzerland indicating an annual growth rate of 7%.

Switzerland is a country with a population of around 8.6 million individuals (about the same as New Jersey). While small in size, Switzerland has traditionally been strong in financial services with a recent emphasis on blockchain-based firms. Zug, Switzerland (outside Zurich) is well known for its entrepreneurial crypto firms. The Crypto Valley Association has emerged as a global voice in the blockchain sector. In more traditional finance, it was estimated in 2018 that Swiss banks held USD $6.5 trillion in assets or “25% of all global cross-border assets.” Pretty impressive.

But while Fintech continued to grow 2019, the sector of finance grew far slower than in 2018 when the market increased a whopping 62%, according to IVZ.

The IVZ report states that about 70% of Swiss Fintechs are providing bank infrastructure or investment management tech.

The report states that seven Big Techs are included among the ten largest companies worldwide thus underlining the “relevance of technology-driven business models, which is also mirrored in the results of the analysis of the revenue models applied by Swiss Fintech companies.”

There is a tendency to apply a revenue model akin to the IT Industry – IE license fees or Software as a Service (SaaS).

While growth may be slowing the number of employees in Fintechs is increasing. Thomas Ankenbrand, study lead and lecturer at the Lucerne University of Applied Sciences and Arts, says:

“This development is not least due to the excellent conditions that Fintech companies find in Switzerland.”

Switzerland is a business friendly jurisdiction with low taxes and a supportive government that wants to encourage a thriving financial services sector.

Zurich and Geneva are recognized as Fintech hubs with solid access to growth funding or venture capital.

On the flip side, Ankenbrand adds that many Fintechs are struggling to find clients – including in the blockchain, or distributed ledger technology (DLT) sector, as relevance is not always readily apparent:

“In the future, DLT could enable efficient, transparent, and traceable data marketplaces,” he adds.

While banking is big in Switzerland, the IVZ report indicates that Swiss banks tend to be risk averse when it come to Fintech. These banks are “reluctant to engage in change the bank activities” and “assign a low priority to the implementation of Fintech solutions.” This sounds like the traditional innovator’s dilemma, popularized by Clayton Christenson. Old banks don’t want to compete with established, and profitable, business lines to the possible detriment of their future existence.

Even while old banks drag their feet, fearful of the digital future, IVZ believes that emerging digital banks will bring technological innovation to the sector.

“This development, together with the increasing offer of financial services by competing BigTech and FinTech companies, could reinforce the innovation pressure on traditional financial institutions in the future.”

Encouragingly, Swiss Regulators and policymakers have been supportive of change.

New legislation enacted on January 1, 2020, the Financial Services Act and the Financial Institutions Act should fundamentally change Switzerland’s financial market architecture.

FINMA or the Swiss Financial Market Supervisory Authority has introduced a Fintech license as well as a Fintech Sandbox. The agency is also seeking to reduce the regulatory burden on financial services firms. A recent move to reduce the compliance burden on Smaller Swiss Banks is emblematic of this mission. The Swiss Federal Council has a dedicated segment on its website focusing on Fintech including blockchain and digital assets.

The Swiss DLT Draft Law is expected to be implemented in 2021, according to the report.