Last week, 50 senior officials convened in Paris to discuss “global issues surrounding virtual assets.” Participants included FinCEN, part of the US Department of Treasury, as well as the Financial Intelligence Unit Germany, France’s Tracfin, and other FATF countries. Virtual asset experts from the Financial Intelligence Units (FIUs) of France, the United States, and Israel offered detailed presentations.

Lucie Castets, Head of International Affairs at Tracfin, issued the following statement:

“Today FIUs are showing that they are fully mobilized to continue working to improve the security of the financial system and enforce the international anti-money laundering and counter terrorist financing standards. To meet this ambitious goal and stand out as central actors in the fight against the misuse of new technologies, including virtual assets, for laundering the proceeds of illegal activities, it is instrumental that FIUs continue to share their operational experiences and expertise.”

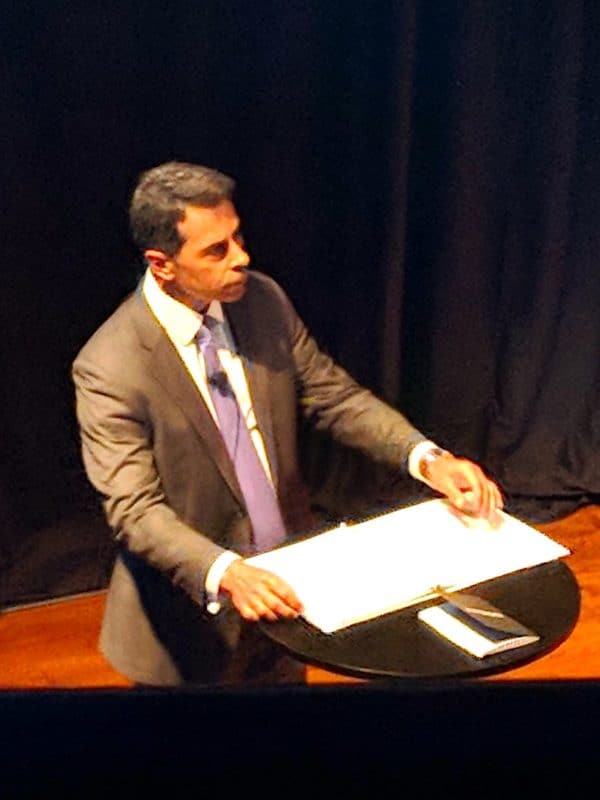

Kenneth A. Blanco, Director of FinCEN, stated:

Kenneth A. Blanco, Director of FinCEN, stated:

“International criminals and bad actors know no borders. They will reliably search for jurisdictions with weak financial integrity controls and, perhaps, insufficiently resourced investigators. It is critical that all FIUs across the world be brought to the same level of skill and vigilance so that criminals and bad actors can find no safe haven. We will continue to bring the expertise of FIUs together to discuss emerging threats, to share effective techniques, and to join forces for our national security.”

Marko Stolle, Deputy Director of the Financial Intelligence Unit Germany, added that the FIUs are team players in their pursuit of dealing with the challenges of digital assets.

FATF rules are being implemented that demand virtual asset service providers (VASPs) track all digital asset transactions with identifiable information. The rules are similar to traditional banking requirements. Cryptocurrency has emerged as a sector of Fintech rife with nefarious activities but new technology and global rules should squelch most illicit activity.