Last month, Crowdfund Insider reported on comments by EC Vice President Valdis Dombrovskis, a Commissioner whose portfolio includes Financial Stability, Financial Services, and the Capital Markets Union, indicating harmonized crowdfunding rules may be forthcoming before the end of the year. In a tweet, Dombrovskis stated there is a “willingness to move forward and find compromises, hopefully still this year” (on investment crowdfunding).

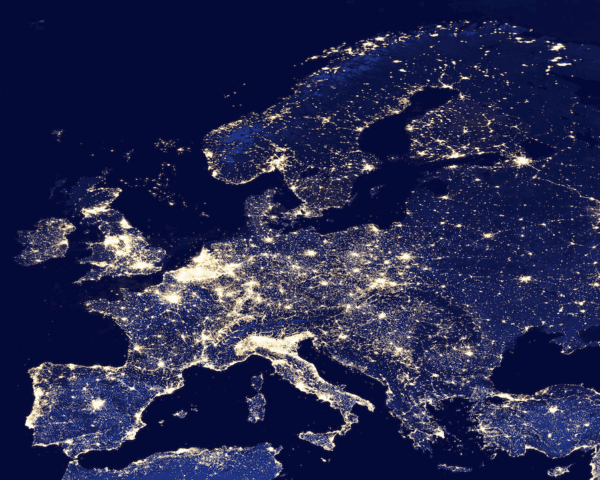

Harmonization across all EU member states could dramatically help European SMEs and entrepreneurs access much-needed growth capital. Platforms could operate across national borders with the assurance of a single set of regulations.

Currently, investment crowdfunding platforms must adhere to national, member state rules which vary dramatically across Europe. This fragmented ecosystem stands in stark contrast to what the European Union ostensibly seeks to achieve. Capital Markets Union has been a longstanding and obvious policy goal of Europe, but while simple in concept, the reality has been far more difficult to accomplish.

The most robust market for investment crowdfunding remains the UK – a country that will sometime soon exit Europe. While the UK platforms will continue to provide online capital formation across the continent, a single set of rules will help all involved. It will also foster competition between crowdfunding providers.

The leading voice for the sector of Fintech has been the European Crowdfunding Network (ECN) an association that has long advocated on behalf of a common-sense approach to regulation. Last month, the ECN published a position paper on what they expect the Commission should produce.

The leading voice for the sector of Fintech has been the European Crowdfunding Network (ECN) an association that has long advocated on behalf of a common-sense approach to regulation. Last month, the ECN published a position paper on what they expect the Commission should produce.

Currently, there are three proposals for regulatory harmonization as the European Parliament, European Commission and the Council have each had their say.

While it appears something (at some point) will be agreed upon, the ECN has itemized its point of view that, hopefully, the Commission will abide by as the industry understands the sector of Fintech better than anyone else.

So what does the ECN seek in final rules?

The ECN has published a position paper that outlines what the industry needs to succeed. The guidance comes in a 12 point outline of key issues. Below is a summary some of the more important aspects of the ECN’s recommendations:

- Investment crowdfunding should be capped at €8 million. “A limit below €8 million is likely to exclude many of the types of businesses that the Regulation is intended to cover, explains ECN. Currently, the €8 million amount aligns with the prospectus requirement and is the de-facto cap utilized in the UK.

- Conflict of interest: ECN states that it is very important that CSPs [crowdfunding service providers] be able to align their interests with those of sheir investors by investing in projects and/or charging carry as part of their fee model.

- Investor classification: ECN believes sophisticated investors must meet one of a set of criteria to be deemed sophisticated:

- (a) EUR 100k own funds; (b) EUR 2m net turnover; (c) EUR 1m balance sheet; and (2) natural persons that meet two of the following: (a) income of EUR 60k or investment portfolio of EUR 100k; (b) has worked in financial sector, or as an executive in a sophisticated legal person, for at least a year; (c) has carried out 10 significant capital markets transactions per quarter over past four quarters

- Bulletin Board: This references secondary transactions. The ECN agrees that a buyer and seller should be able to transact on crowdfunded securities while stating there should not be an internal matching system.

- Customer due diligence KYC: CSPs must apply due diligence measures including identifying the residency of an investor

- Due diligence on issuers: ECN believes that due diligence is very important but the Parliament’s version (the only one provided) is not practical.

- Entry Knowledge Test – consequences of failure: This has to do with risk notifications and the reality that many early stage investments have a high risk of failure. The ECN believes CSPs must warn non-sophisticated investors who fail or refuse to complete test but may still allow them to invest

- Investment limits – There should be none.

There are other recommendations included in the position paper.

The ECN welcomes forthcoming regulation and believes it will have a positive impact on European startups and SMEs – as well as investors:

“A harmonised regime will at last make it possible for CSPs to provide their services on a fully cross-border basis within Europe, and with this will come an increase the volumes, quality and professionalism of crowdfunding across the continent.”

Now it is up to the Commission to decide what to do. Hopefully, policymakers will take advantage of this opportunity to move forward with the future of online capital formation and foster a workable and robust crowdfunding ecosystem.

The ECN Position Paper is available here.