Financial Innovation Now (FIN) has published an open letter to the incoming Trump administration. FIN demanded the President-Elect embrace technology when it comes to financial innovation.

FIN is a group that represents several very big names in tech. Think Apple, Google, Amazon and more. Tipping their hand as to their interest in providing financial services to their millions of users, FIN has been advocating on behalf of Fintech and a more forward thinking policy and regulatory approach. The step between processing transactions online to one where additional financial services are provided is not very big. The challenge is in the current byzantine regulatory approach.

FIN is a group that represents several very big names in tech. Think Apple, Google, Amazon and more. Tipping their hand as to their interest in providing financial services to their millions of users, FIN has been advocating on behalf of Fintech and a more forward thinking policy and regulatory approach. The step between processing transactions online to one where additional financial services are provided is not very big. The challenge is in the current byzantine regulatory approach.

Old finance is terrified of the Bank of Apple but competition must exist for consumers (and small businesses) to benefit from Fintech innovation.

Brian Peters, the Executive Director of FIN, has suggested that Trump create, and appoint, a “Treasury Undersecretary for Technology”. This new position would help guide the US in modernizing financial services and help the country maintain its competitive position in the global financial services sector.

Brian Peters, the Executive Director of FIN, has suggested that Trump create, and appoint, a “Treasury Undersecretary for Technology”. This new position would help guide the US in modernizing financial services and help the country maintain its competitive position in the global financial services sector.

Crowdfund Insider has advocated on behalf the creation of a Cabinet-level “Innovation Czar”. But having an Undersecretary for Technology (specifically Fintech) is not a bad thing.

Read Financial Innovation Now’s letter below.

November 30, 2016

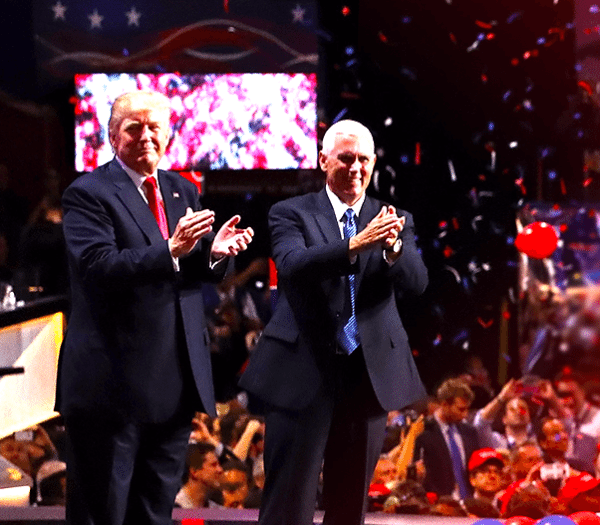

The Honorable Donald J. Trump

President-elect of the United States

Trump-Pence Transition Team

1717 Pennsylvania Ave, NW

Washington, DC 20006

Dear President-elect Trump:

On behalf of Financial Innovation Now, I would like to congratulate you on your recent election. Financial Innovation Now (“FIN”) is an alliance of leading innovators promoting policies that empower technology to make financial services more accessible, safe and affordable for everyone. We look forward to working with you, your transition team, and the individuals you appoint as the nation’s federal financial regulators.

Technology and the internet are changing the way consumers and small businesses manage money, access capital, and grow commerce. Financial regulators around the world are paying close attention to this transformation and actively working to adopt policies that attract investment and create jobs in these new services, ultimately benefiting their own consumers and businesses. While America’s financial regulators and Congress have recognized this potential on a bipartisan basis, more leadership and federal coordination is necessary.

You campaigned on a promise to bring change to Washington, and your business experience, unique for any incoming President in history, offers a rare leadership opportunity that we believe sets the stage for modernizing some of our most antiquated financial rules. We are optimistic that you and your administration are well positioned to make America great at innovating in financial services and growing these jobs here at home.

We urge your administration to adopt a national vision and coordinated strategy to 1) ensure we grow financial technology jobs in the US, and 2) foster competition and innovation in financial services to better serve consumers and the economy. To achieve these goals we offer the following recommendations:

Appoint Financial Regulators Who Value Technology’s Potential: As innovators, we believe strongly in a balanced regulatory environment that promotes market-based solutions. We are pleased that some federal financial regulators have recently recognized the tremendous benefit of new financial technologies, particularly its ability to grow commerce and help the underserved. These agencies have developed a number of initiatives and programs to enable innovation in financial services. The Consumer Financial Protection Bureau, through Project Catalyst, encourages consumer-friendly innovation and actively engages with the innovator community. It has pioneered a nascent no-action letter program that may offer a valuable “testbed” for new technologies navigating regulatory obligations. Likewise, the Office of the Comptroller of the Currency’s “Innovation Initiative“ is seeking to improve the agency’s understanding of technology trends and better facilitate responsible innovation for its chartered institutions and their partners. The Treasury Department has also examined trends in technology-enabled lending that are making access to capital far more achievable for America’s small businesses. Other agencies are also active. While somewhat disparate and in need of greater coordination, it is helpful that these agencies have embraced the benefit of technology-enabled competition in financial services and are exploring ways to foster this growing part of our economy. FIN urges you to consider appointing financial regulators who value technology and who will seek to promote innovation as a means to foster competition in financial services. In particular, we encourage the appointment of a Treasury Undersecretary for Technology, responsible for developing a national vision and coordinated strategy to ensure America is the best country to create companies and grow jobs developing financial technologies; and work across all federal financial regulators to foster competition and innovation in an antiquated banking sector to better serve consumers and the economy.

Promote Open, Interoperable Standards for Card Payment Security: Technology innovators are developing numerous methods to protect security and authenticate payments conveniently; this constant evolution is necessary to drive down fraud and stay ahead of hackers. In contrast, incumbent financial services companies are building closed and proprietary networks, which locks out innovation and diminishes the greatest potential security and fraud reduction methods. FIN urges your administration to scrutinize technological barriers to payment security innovation and explore authentication methods that are truly standards-based, open, and interoperable.

Streamline Money Transmission Licensing: Payment innovators currently must obtain and continually update money transmission licenses in nearly every state. Consumer protection is a critical part of payments regulation, but it makes no sense for different states to regulate digital money differently from one state to another, especially if that process significantly delays entry to market and prevents consumers and businesses in many states from having equal access to cutting edge payments technologies. FIN recommends that your administration work with Congress and state regulators towards a streamlined federal money transmission licensing system that ensures adequate consumer protections while facilitating access to new payments services across the nation.

Ensure Consumer Access to Financial Accounts and Data: Consumers are using new applications to better manage their financial lives and leverage their own financial data to qualify for better rates and services. Consumers need clear access to their financial accounts to enable these benefits, but some financial institutions have blocked them. FIN recommends that your administration work to empower consumers to securely access their own accounts via whatever application or technology they wish, without charges that favor any one application or technology over another.

Streamline Small Business Access to Capital via the Internet: America’s entrepreneurs should have easy access to capital to grow their companies and jobs, but many small businesses are simply not served by traditional banks using old, slow and costly underwriting methods. Technology companies that already serve America’s small businesses are empowering those businesses with new online tools to prove their creditworthiness as a business, and quickly obtain affordable capital. Antiquated state lending rules did not contemplate internet-based services, and these inconsistencies may actually hold back the availability of capital from main street businesses that need it most. FIN recommends that your administration and Congress should streamline lending laws across state jurisdictions to account for the innovative lending market of today.

Help Consumers and Businesses Manage Money with Real-time Payments: In the US, payments and check deposits can take days to clear through the legacy bank systems, whereas other countries already have real-time payments. American consumers cannot afford delays in accessing their own money. Unfortunately, these delays cause many Americans to instead turn to high-cost check cashing alternatives or pay-day loans to cover real expenses. FIN urges your administration to ensure the availability of real-time payment networks for all Americans by 2020 and ensure such networks are affordable and secure.

Leverage Mobile Technology to Increase Financial Inclusion: According to the FDIC, twenty eight percent of households in the US are unbanked/underbanked, but the internet and mobile technology are lowering barriers to financial services. Mobile applications, in particular, are enabling the financially underserved to better control and manage their financial lives. FIN urges your administration to promote technology and mobile financial services as a means to overcome old barriers to financial services.

In closing, we look forward to working with you, your transition team and your new Administration on a range of policy questions related to financial technology. As we continue working to bring market some of the most innovative and secure financial technology products available to consumers and businesses today, we are hopeful your team will embrace the essential role that technology plays in the democratization of finance.

Thank you for considering our points of view and we look forward to working together constructively.

Brian Peters

Executive Director

Financial Innovation Now