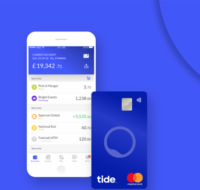

UK SME Challenger Bank Tide Announces First Paid Plan “Tide Plus”

Tide, a UK-based SME challenger bank, announced on Wednesday it is set to launch its new paid plan, Tide Plus. According to Tide, Tide Plus is an upgraded account that gives users “additional support” for running their businesses.” According to Tide, the upgraded membership will… Read More

Read more in: Fintech | Tagged challenger bank, SME, tide, uk, united kingdom