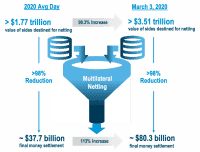

The Depository Trust & Clearing Corporation Advocates Transition to T+1 Settlement

Following the Gamestop/Reddit/Robinhood melodrama, the discussion of when trades settle has become a topic of concern. Currently, if you purchase shares from a broker you must pay for those shares within two days of the trade (T+2), something the Securities and Exchange Commission adopted in… Read More

Read more in: General News, Fintech, Politics, Legal & Regulation | Tagged depository trust and clearing corporation, dtcc, murray pozmanter, t+1