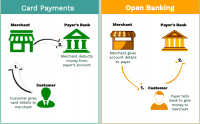

DNA Payments Supports Open Banking for PoS Payment Terminals

DNA Payments is bringing more flexible payment options to the payments space, being one of the first to market in the UK by launching Open Banking for its axept PRO payment terminals, offering merchants even more ways for their customers to pay. The introduction of… Read More

Read more in: Fintech, Global | Tagged dna payments, flexible payments, open banking, uk, united kingdom