The Federal Reserve has decided to hold rates steady in a decision that came as no surprise.

The Federal Open Market Committee (FOMC) voted unanimously to keep rates at 4.25% to 4.5%.

The FOMC added that it will continue reducing its holdings of Treasury securities, agency debt, and agency mortgage‑backed securities.

The statement indicated that the Fed was ready to alter course if market dynamics changed.

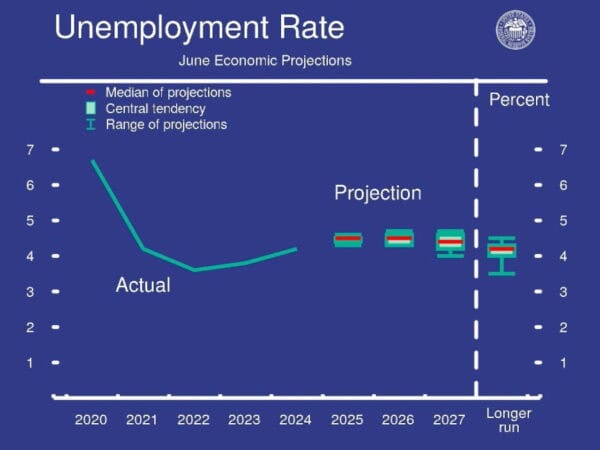

As always, the Fed’s mission is to keep inflation at 2% and maintain full employment.

Conventional wisdom is the Fed will cut rates perhaps in September or December, but, for now, the bank is in a holding pattern. Part of the challenge is the geopolitical issues as well as the fog of tariffs, which remain an unknown. While President Donald Trump would like the Fed to cut rates, his policies have undermined the Fed’s ability to do so, as clarity on trade deals will take some time.

On a more positive note, mortgage rates, which are tied to the 10-year, saw the 30-year fixed-rate mortgage (FRM) average 6.81%, down from last week when it averaged 6.84%. A year ago, the 30-year fixed-rate mortgage averaged 6.87%.