Apple (NASDAQ:AAPL) has issued a statement in recognition of ten years of Apple Pay. In many respects Apple is one of the largest Fintechs in the world due to its global reach and ubiquitous nature of its products – most importantly the iPhone. Apple reported that Apple Pay is in use by hundreds of millions of consumers in 78 markets, millions of websites and apps, in tens of millions of stores worldwide. Apple Pay is also supported by more than 11,000 banks and other network partners.

Apple added that consumers love the product. Ninety percent cited ease of use, and around 88 percent said security and privacy made the payments feature a favored application.

Jennifer Bailey, Vice President of Apple Pay and Apple Walletice, said they are now bringing users more ways to pay, including rewards and access installment loans from Apple Pay at the checkout with Apple Pay online and in-app on iPhone and iPad.

“Beyond payments, we’re also advancing our broader vision of replacing users’ physical wallets with an easy, secure, and private digital wallet — Apple Wallet. Today, users can seamlessly and securely add and access eligible event tickets, transit cards, keys, government IDs, and more all from Apple Wallet. And we’re always looking for new ways to make using Apple Wallet convenient while delivering unparalleled security and peace of mind,” said Bailey.

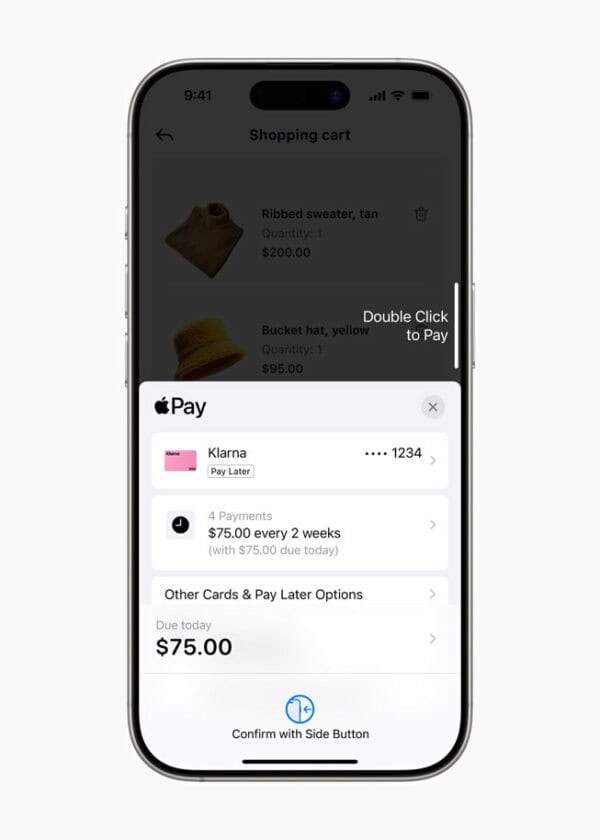

Apple shares that Klarna—a BNPL/payments Fintech—will be available to users in the UK and the US as of today. Installment loans are available from Affirm in the US and Monzo in the UK.

Going forward, users will be able to access installment payment options from credit or debit cards when making online purchases with Apple Pay in the US with Citi, Synchrony, and participating Apple Pay issuers with Fiserv.

In Australia, Apple has partnered with ANZ, in Singapore with DBS, in Spain with CaixaBank, and additionally, in the U.K. with HSBC, NewDay, and Zilch. Apple said more partners in the UK will follow.

Next year, customers in the US will be able to see their PayPal balance when using their PayPal debit card in Apple Wallet, providing more information for users of the service.

Beyond Apple Pay, the Apple Card is a popular credit card in partnership with Goldman Sachs. While Sachs wants out, the expectation is that Apple will partner with another large financial services firm.

Apple Savings is another Fintech tool that enables users to park cash and earn interest at a rate higher than many big banks. What is missing is a full-stack investment platform, which should be forthcoming in the future.

While Apple has pumped the breaks on launching in-house financial services to pursue more collaborations, provide more user choice, and build a firewall against jurisdictions that worry about Apple’s dominance, offering stocks/bonds/crypto is probably coming via multiple partners.

In early trading, Apple’s shares are moving higher…