Oppenheimer is out with its 2022 picks and Coinbase (NASDAQ:COIN) has made the list. The analyst providing the coverage has set a $444 price target for the crypto exchange, a significant increase over its current per-share price that hovers around $252/share.

Oppenheimer is out with its 2022 picks and Coinbase (NASDAQ:COIN) has made the list. The analyst providing the coverage has set a $444 price target for the crypto exchange, a significant increase over its current per-share price that hovers around $252/share.

Coinbase became a public company this past spring and its shares have traded as high as $429 each so Oppenheimer is pretty bullish on the stock.

Expectations are for Coinbase to continue to benefit from both institutional and retail adoption of crypto and the recognition of the asset class as an alternative investment beyond stock, bonds, etc. Coinbase may also look to make an acquisition as it is “well-positioned” because of its strong balance sheet and solid cash flow. Last month, Coinbase announced the acquisition of Unbound Security in a move to boost its cybersecurity defenses.

As of September 2021, Coinbase serviced more than 73 million customers worldwide trading $327 billion during Q3 holding $255 billion in assets on the platform.

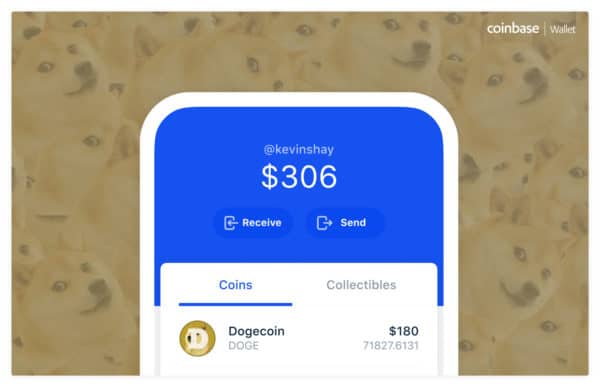

Coinbase while best known as the largest crypto exchange in the US it is really morphing into a digital asset neobank that aims to provide a one stop shop for all its users as the financial super app of the future.

The number one risk to Coinbase’s success? Regulation. Of course, as the government tiptoes around providing better guidelines for the digital asset sector.