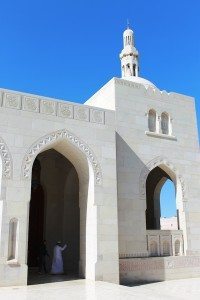

Fitch Ratings reports that the Islamic banking ecosystem in Oman is expected to continue growing during 2021-2022 after rather strong momentum last year. This, despite the COVID-19 outbreak and historically low oil prices, Fitch Ratings noted.

Fitch Ratings reports that the Islamic banking ecosystem in Oman is expected to continue growing during 2021-2022 after rather strong momentum last year. This, despite the COVID-19 outbreak and historically low oil prices, Fitch Ratings noted.

Islamic financing in the MENA region country expanded by 9.5% last year, when compared with the traditional banks’ loan growth of just over 2%, the report added. It also mentioned that the growth was mainly driven by rising demand for Islamic or Sharia-compliant products, support from incumbents providing such products via their Islamic division, and progressive regulations that support the development of Islamic finance.

As mentioned in a report from Fitch Ratings:

“The market share of Islamic banking and Islamic windows increased to 14.3% at end-2020 (end-2019: 13.6%), with total assets of OMR5.1 billion (USD13.5 billion). This is high considering that Oman was the last Gulf Cooperation Council (GCC) country to introduce Islamic banking in 2013. In contrast, Islamic banking has been present in Indonesia and Turkey for more than two decades but market shares there are below 8%.”

The report added that Oman-based Islamic banking institutions are “adequately capitalized” with “reasonable” profitability and “asset quality indicators, reflecting conservative regulation and relatively low-risk business models.” The report also mentioned that payment holidays and “flexibility allowing banks not to classify financing as impaired when payments are deferred mask underlying asset quality.”

Fitch Ratings further noted that they “expect the weakening operating environment to pressure profitability and asset quality in 2021-2022, particularly in the real estate, construction, and manufacturing sectors.”

But the industry’s growth potential is “high given Oman’s Muslim-majority demographics and low banking penetration,” the report added while noting that “only 56% of the adult population had a bank account in 2016, with 14% of adults citing religious reasons for not having an account, according to the World Bank.” The report further revealed that Islamic banking penetration is “likely to increase through training and awareness campaigns, new products and the greater use of fintech to target customers.”

The Fitch Ratings report continued:

“Challenges for the [Omani Islamic banking] sector include limited short-term sharia-compliant investment options to place excess liquidity, a relatively low capital base and low customer awareness of Islamic products. Short-term sharia-compliant investment options are limited due to regulations preventing Islamic banks and Islamic windows from placing funds with conventional banks or parent banks, and the regulatory ban on ‘tawarruq’ products, which in other Islamic finance jurisdictions are typically used for interbank funding and personal financing.”

The report added that these factors “constrain profitability.”

Islamic banks in the Middle Eastern nation can, however, receive funds from regular banks and parent banking institutions, “provided the underlying contract is sharia-compliant.” There are “no Islamic repo facilities with the central bank, which is problematic during tight liquidity conditions, but Islamic windows have the benefit of largely fungible capital and liquidity from their conventional parent banks,” the report clarified.

The Central Bank of Oman (CBO) is currently working on providing Islamic liquidity management via “remunerative deposit accounts and a standing liquidity facility, and by acting as lender of last resort,” the report revealed. The CBO is also working to “expand domestic-currency sukuk issuance, which should increase sharia-complaint options for Islamic banks and help them to manage their liquidity.” The report further noted that Sukuk issuance “currently represents about 22% of total listed bond and sukuk issuance in Oman.”

The report added:

“Omani Islamic banks have smaller capital bases than their conventional peers, hindering their ability to participate in large government financing projects. Government and public enterprise projects represented only 4.6% of the financing mix of Islamic banks and windows at end-2020, compared with 15% for conventional banks. Sector consolidation would therefore be credit-positive. A notable development in 2020 was the takeover of Alizz Islamic Bank by Oman Arab Bank.”

The Fitch Ratings report concluded:

“Under Oman’s Islamic Banking Regulatory Framework, any losses on ‘mudaraba’- and ‘musharaka’-based profit-sharing investment accounts (PSIAs) are borne by the account holders, although we have not seen cases of PSIAs bearing losses in practice. In future, PSIA losses will be covered by a sharia-compliant version of the Bank Deposits Insurance Scheme, currently under development.”