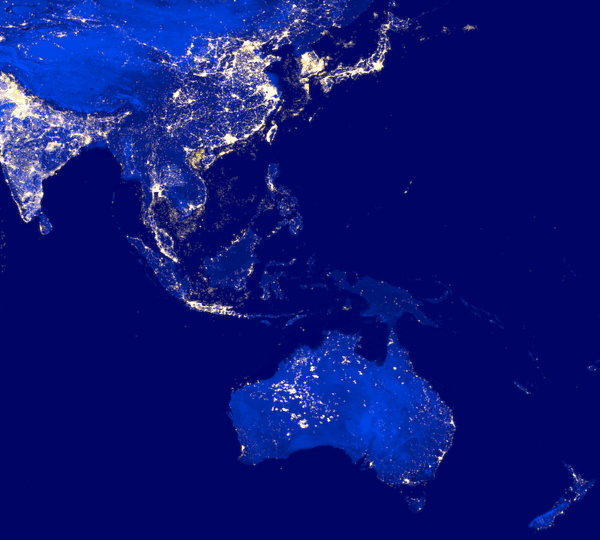

Australia’s marketplace trade credit platform Marketlend recently announced it has expanded its Asian division by appointing Andrew Ross to lead origination and insurance endeavors for Marketlend throughout Asia. Ross will notably assist Marketlend to expand its presence in trade commodities, insured backed discounted trade credit and distressed debt.

“With international trade credit underwriting experience spanning three decades, Ross started his career in looking after European export markets for Trade Indemnity before going on to work for QBE in both Australia and Hong Kong, initially in domestic underwriting, and then as head of the North Asia division. In 2015 Ross headed up the Global client’s division at Coface, before joining Bond & Credit in 2017 to start their international business.”

While speaking about the appointment, Leo Tyndall, Marketlend CEO and Founder, stated:

“Andy’s remarkable track record makes him a critical part of our expansion in Asia and I’m excited to welcome Andy on board as we continue to go from strength to strength. Due to the high demand of Marketlend’s insured trade receivables lending offerings throughout Asia, Andy will be instrument to assisting in origination and insurance development plans throughout Asia.”

Ross went on to add:

“I’m thrilled to be joining Marketlend at such a pivotal time and look forward to continuing current negotiations with numerous financiers to assist them in the reduction of trade credit exposure within Asia, the Middle East, and Oceana.”

Founded in 2014, Marketlend specializes on providing funding solutions to SME Borrowers, including Supply Chain Finance, Debtor Finance, and unsecured Lines of Credit. The platform also offers investors secure and robust investments in businesses with loss protection and insurance.