Crowd Bonds, a type of debt-based crowdfunding, are gaining traction in the healthcare investment sector with a particular focus on high quality care homes, according to UK crowdfunding platform Downing Crowd. Downing Crowd itself has launched a new £2.5 million Crowd Bond for two established care homes located in Scotland. Both homes are operated by Care Concern Limited, a high-quality care provider.

Crowd Bonds, a type of debt-based crowdfunding, are gaining traction in the healthcare investment sector with a particular focus on high quality care homes, according to UK crowdfunding platform Downing Crowd. Downing Crowd itself has launched a new £2.5 million Crowd Bond for two established care homes located in Scotland. Both homes are operated by Care Concern Limited, a high-quality care provider.

“We are constantly developing our business to provide the best care facilities and comfortable surroundings for our residents and are pleased to partner with Downing on this Crowd Bond,” indicated Care Concern Group CEO Manpreet Johal. Downing’s speed and flexibility, sector knowledge and partnership approach have enabled us to move quickly in acquiring the freeholds of these two sites and will allow us to further improve the quality of the physical environment of the homes.”

To date, Downing has invested over £45 million in 11 care homes. Earlier this year, the Downing Crowd platform also successfully raised £3 million for a luxury care home in Edinburgh with the same management team, hitting the target investmentwithin eight days. Investing in this type of market is not entirely new to Downing either, with the company gradually building its expertise over time after making its first move into the sector back in 1998.

[clickToTweet tweet=”Another Successful Raise! #WomeninFinTech @Downingcrowd @juliasgroves #careconcerngroup @crowdfundinside” quote=”Downing Crowd: Crowd Bonds+ Care Homes= £2.5 Million Raise”]

Shifting demographics have created ideal conditions for fresh investment in the sector, but finding the right opportunities also requires a careful eye, explains Head of Downing Crowd Julia Groves:

“With the number of people aged over 85 estimated to increase by 60% between 2014 and 2025, the demand for care homes – and the financing to support it – looks set to increase rapidly in the coming years. However, investors should be wary of simply surfing this trend, as there are clear issues in some areas of the sector around the quality of care, which means we have placed very high importance on rigorous assessment and due diligence of the team operating the homes.”

“With the number of people aged over 85 estimated to increase by 60% between 2014 and 2025, the demand for care homes – and the financing to support it – looks set to increase rapidly in the coming years. However, investors should be wary of simply surfing this trend, as there are clear issues in some areas of the sector around the quality of care, which means we have placed very high importance on rigorous assessment and due diligence of the team operating the homes.”

What can care home Crowd Bonds offer investors? Downing Crowd Bonds are a type of debt-based crowdfunding that allow investors to lend directly to a wide range of UK businesses via Bonds that are secured against the operational assets of the borrowing company. This is often known as an ‘asset-backed’ bond and means that if the borrower defaults on the Bond, Downing can sell these assets to help ensure investors get their money back.

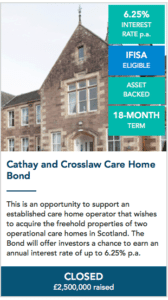

This latest asset-backed care home Bond launched by Downing will reportedly allow investors to earn up to 6.25% p.a. interest over 18 months and there is also the opportunity to earn this interest tax-free if an investor opens a Downing Innovative Finance ISA.

The latest £2.5 million care home Bond will support two care homes. The first is Cathay Nursing Home, a purpose built 40-bed care home located in the Scottish county of Moray. Situated in a peaceful setting close to Forres Golf Course, the living accommodation and communal areas are finished to a good standard with all bedrooms having en-suite facilities. The funding support will also go towards Crosslaw house, a care home with capacity for 45 older people, including one adult with learning needs, based on the outskirts of Lanark.

The latest £2.5 million care home Bond will support two care homes. The first is Cathay Nursing Home, a purpose built 40-bed care home located in the Scottish county of Moray. Situated in a peaceful setting close to Forres Golf Course, the living accommodation and communal areas are finished to a good standard with all bedrooms having en-suite facilities. The funding support will also go towards Crosslaw house, a care home with capacity for 45 older people, including one adult with learning needs, based on the outskirts of Lanark.

Current live campaigns include Bagnall Energy Regular Access Bond, Pulford Trading Regular Access Bond and Warren Energy AD Bond. As at July 2017, the platform had raised over £33 million on behalf of small UK businesses, having successfully launched 16 Bonds. Downing Crowd’s first Bond, Kenninghall Solar, sold out within two weeks and some of its more recent launches have also been popular; Nightjar Sustainable Power Limited sold out within seven days. The FCA authorized platform currently has 0% bad debt, counts 35,000+ investors and holds in excess of £950 million of funds under management.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!