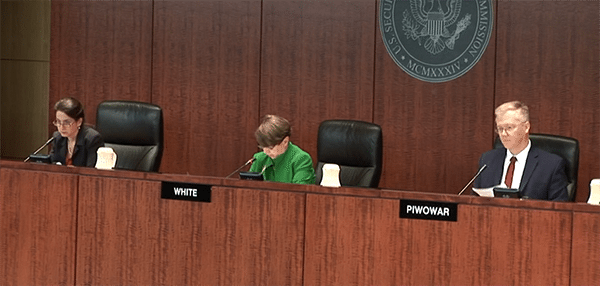

On October 26, 2016, the SEC’s three Commissioners convened at their headquarters to adopt new rules intended to modernize what had historically been a little used path of raising capital for startups, early stage businesses and community-based enterprises: the so called intrastate exemption. It had its origins in our federal securities regulation legislation adopted back in 1933, which required the federal registration of the sale of securities in the U.S. absent an exemption from registration.

In 1933 Congress, in its wisdom, carved out from the registration requirement those offerings that were purely local in character, where offers and sales were made by local businesses within their state borders. This area it left to regulation by the states – on a state by state basis – with each state left to decide for itself how best to balance the need to protect its investing public with the ability of local businesses to access capital.

And to facilitate the utilization of this exemption from registration the Commission enacted Rule 147, intended to be a non-exclusive safe harbor to facilitate compliance with the federal exemption.

Over the years it became more and more apparent that both the exemption itself and the Rule were flawed – hence its use languished – in favor of other more manageable exemptions from federal registration. Its use was generally shunned by securities lawyers, as it was too easy to fall out of compliance with its requirements.

And time was not kind to the intrastate exemption. If your business was a corporation, the statutory exemption was limited to corporations incorporated in the state where the offering occurred, thus excluding local businesses who might elect to incorporate in out of state jurisdictions. And with the onset of the Internet in the 1990’s the Commission struggled with how to address offers by a local business on the internet which by their very nature would cross state borders. This struggle came to a head in 2014, when the SEC Staff issued an informal interpretation, a “CDI” (compliance and disclosure interpretation), opining that unrestricted Internet solicitation and advertising of an offering was taboo for an offering relying on the intrastate exemption. This effectively put a damper on local investment crowdfunded offerings in the dozens of states that had adopted, or were to adopt, intrastate crowdfunding statutes relying on the intrastate exemption.

The 2014 CDI was greeted with a growing chorus of mystified securities lawyers, state securities regulators and small business advocates. At a time when the SEC was dragging its feet to adopt regulations to implement interstate (nationwide) investment crowdfunding, it had in effect shut off many states from enacting local crowdfunding statutes which would enable SME’s to leverage the Internet in local investment crowdfunding campaigns.

In 2015 the Staff at the SEC’s Division of Corporation Finance took the bull by the horns, recommending that the Commission adopt new rules to modernize and expand the federal intrastate crowdfunding exemption. On October 30, 2015, the same day that the Commission adopted the long-awaited final rules implementing JOBS Act Title III crowdfunding, it came with its own October surprise: proposed rules to update and expand the intrastate exemption – notably, allowing unrestricted Internet advertising of an offering.

In 2015 the Staff at the SEC’s Division of Corporation Finance took the bull by the horns, recommending that the Commission adopt new rules to modernize and expand the federal intrastate crowdfunding exemption. On October 30, 2015, the same day that the Commission adopted the long-awaited final rules implementing JOBS Act Title III crowdfunding, it came with its own October surprise: proposed rules to update and expand the intrastate exemption – notably, allowing unrestricted Internet advertising of an offering.

One year later, on October 26, 2016, the Commission adopted final intrastate crowdfunding rules, much improved from the proposed rules. Gone in the final rules, among other things, was a provision which would have prohibited state legislatures and state securities regulators from authorizing local investment crowdfunded offerings in excess of $5 million per year. Though no state has yet to authorize crowdfunded offerings above this amount, virtually all of those who commented on the propose rules were unanimous: this was a matter best left to the discretion of each state – not the federal government. And in the UK, where investment crowdfunding has flourished, the $5 million dollar ceiling has been broken and is expected to go higher.

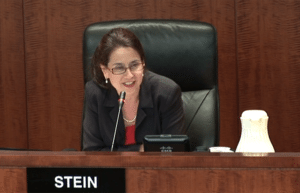

Though the vote by the Commissioners on the final rules was unanimous, not so with the sentiment of the Commissioners. In Commissioner Kara M. Stein’s public remarks on the final rules, she was not shy about expressing reservations about the ability of the individual states to protect their local residents from questionable offerings and bad actors, cautioning of the need for continuing federal oversight:

“Today’s rules amend Rule 147, and create a new federal offering exemption known as Rule 147A. Hopefully, the updated safe harbor and new exemption before us today will foster opportunities and create new paths forward for such smaller firms, while still safeguarding investors.”

“At least, this is the theory. Like other experimental capital-raising rules, such as Regulation A+ and Regulation Crowdfunding, only time will tell how well the theory works in practice. Only time will tell whether we can relax capital-raising regulations, while also maintaining appropriate investor protections. So, while today’s rules may provide smaller companies with additional funding opportunities, today’s rules also raise some investor protection concerns.”

And in closing her remarks, Commissioner Stein again emphasized what she viewed as the “experimental” nature of these new rules:

“Today’s amendments to Rules 147 and 504 and the new exemption under Rule 147A are part of a suite of rules focused on providing options for smaller businesses seeking to raise capital. On balance, I think they are worth the experiment. However, by collecting, sharing, and examining data on how these new options are working in practice, we should be able to recalibrate these rules if the experiment is not working out as planned.”

Most respectfully, I must take exception to Commissioner Stein’s characterization of these rules. It is not a question of whether the glass is half full, or half empty. In my opinion, the glass, from Commissioner Stein’s perspective, is simply upside down.

The real “experiment,” historically, dates back not only to 1933, when Congress first carved out this statutory reservation of power to the states. The “experiment” also dates back to 1776, when our Founders adopted a Constitution which gave specified powers to the federal government, with all other powers being reserved to the states. The “experiments” our Founders had in mind were those which would take place under laws enacted by each of the states – as they, and not the federal government, saw fit. States were to set up their own laboratories of experiment for matters uniquely concerning their residents, and occurring within their borders – free from interference by a federal bureaucracy.

The real “experiment,” historically, dates back not only to 1933, when Congress first carved out this statutory reservation of power to the states. The “experiment” also dates back to 1776, when our Founders adopted a Constitution which gave specified powers to the federal government, with all other powers being reserved to the states. The “experiments” our Founders had in mind were those which would take place under laws enacted by each of the states – as they, and not the federal government, saw fit. States were to set up their own laboratories of experiment for matters uniquely concerning their residents, and occurring within their borders – free from interference by a federal bureaucracy.

Seems that Commissioner Stein never got that memo. In her view, it would be up to the SEC to “recalibrate” the new rules if the states get it wrong – in the judgment of the Commission, of course.

So Why Does Any of This Matter?

It would be easy to be dismissive of the recently adopted intrastate rules. After all, historically the intrastate exemption has not been in favor –there have been much better options – with far fewer pitfalls. Even more so now, with new pathways of capital formation opened up by the JOBS Act of 2012. And with the advent of federal investment crowdfunding, most would yawn when examining the seemingly unimpressive statistics for the use of intrastate crowdfunding during brief period in which intrastate crowdfunding has been allowed.

I submit that current statistics are not very meaningful – as they do not tell the whole story. There is a lag between the time that new capital raising paths are created and when they become “mainstream.” And let us not forget – until these new rules go into effect (April 2017), as a general matter broad internet solicitation is not permitted in intrastate crowdfunded offerings relying on the current Rule 147 – covering most of the 35 states which have adopted their own intrastate crowdfunding statutes. And crowdfunding without the Internet is more akin to a day without sunshine. Not much can grow in that environment.

Size Does Not Always Matter

Statistics, however, do not tell the whole story. Most businesses start out as local businesses. But when it comes to allocating investor capital in SME’s, most of it winds up in California, New York, and Massachusetts, leaving the vast majority of this country as “capital deserts.”

Those are not my words. They are the words of US Congressman and Deputy Whip Patrick McHenry, who hails from the Great State of North Carolina – the same gentlemen who has been unrelenting in his efforts to implement smart federal legislation intended to remove unnecessary federal regulatory barriers to SME capital formation: starting with the JOBS Act of 2012, and continuing to this day with a host of bills to further improve the access of SME’s to much needed capital – especially in capital-starved “flyover” states.

Those are not my words. They are the words of US Congressman and Deputy Whip Patrick McHenry, who hails from the Great State of North Carolina – the same gentlemen who has been unrelenting in his efforts to implement smart federal legislation intended to remove unnecessary federal regulatory barriers to SME capital formation: starting with the JOBS Act of 2012, and continuing to this day with a host of bills to further improve the access of SME’s to much needed capital – especially in capital-starved “flyover” states.

Make no mistake about it. This is not a political issue, notwithstanding the heated rhetoric in 2016 which has saturated our media. To put a fine point on this, I offer the views of our Democratic Vice President, Joe Biden, spoken in 2014 at the U.S. sponsored Global Economic Summit, on the other side of the world in Morocco to an assembly of thousands of entrepreneurs and government officials, including the head of the U.S. Small Business Administration, Maria Contreras – Sweet.

“The single most valuable resource on this planet I think we could all agree on in this room is not what’s in the ground, but what’s in the mind. It’s the single least explored part of the world, the mind. The things that are going to happen in the next two, five, 10, 15 years are breathtaking. Investors, they have to be willing to expand the horizon and invest in early stage entrepreneurs — not only in Silicon Valley — but . . . everywhere, everywhere where there’s talent.”

“Governments have to unlock the marketplace of ideas by allowing people to express their views openly about what they’re thinking and what they’re trying.”

“Governments have to unlock the marketplace of ideas by allowing people to express their views openly about what they’re thinking and what they’re trying.”

“They must unlock the commercial marketplace by eliminating barriers to access to capital; ensuring that rules are fair and predictable, removing excessive cumbersome regulations.”

“The government can’t grow the economy by itself. As a matter of fact, it’s not the major reason. It’s a catalyst for growth — no matter how big the megaproject. To prosper in the 21st century, you also need to grow from the bottom up, allowing your people to unlock their talents through private enterprise and political and economic freedom and action.”

And there was some irony – not apparent from the remarks themselves. They were spoken at a U.S. sponsored world conference intended to promote entrepreneurial activity in Muslim-majority countries – one of former Secretary of State Clinton’s initiatives started by her back in 2009.

So let’s not be too “provincial” when pronouncing judgment on who knows best, when it comes deciding how investors should best be protected – or what is needed to enhance capital formation for SME’s – or where those funds are needed most – especially when the boundaries of that “province” are marked by the Washington Beltway – and the matters at hand reside within the borders of a single state.

So let’s not be too “provincial” when pronouncing judgment on who knows best, when it comes deciding how investors should best be protected – or what is needed to enhance capital formation for SME’s – or where those funds are needed most – especially when the boundaries of that “province” are marked by the Washington Beltway – and the matters at hand reside within the borders of a single state.

So let’s wake up – and give some deference to our local communities, big and small, U.S. entrepreneurs everywhere, including in the flyover states, and the state legislatures which regulate them. Sometimes big ideas start in small, seemingly unlikely places.

“Bite-size” businesses, in the aggregate, are important to our economy and job creation. And in  this day and age of readily accessible technology “Uber” sized businesses often have their genesis with relatively modest amounts of capital.

this day and age of readily accessible technology “Uber” sized businesses often have their genesis with relatively modest amounts of capital.

After all, it’s why one notable leader championing the importance of local investing, and New York Times contributor, Amy Cortese, calls it “Locavesting,” – not “Loco” – vesting.

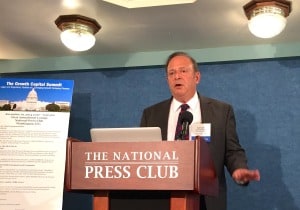

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider, is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. Guzik is also former President and Board Chair of the Crowdfunding Professional Association (CfPA) and currently CfPA Legislative & Regulatory Special Counsel. A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium sized business, he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. In 2014, some of his speaking engagements have included leading a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy, a panelist at the MIT Sloan School of Business 2014 Crowdfunding Roundtable, and a panelist at a national bar association event which included private practitioners, investor advocates and officials of NASAA. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation.

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider, is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. Guzik is also former President and Board Chair of the Crowdfunding Professional Association (CfPA) and currently CfPA Legislative & Regulatory Special Counsel. A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium sized business, he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. In 2014, some of his speaking engagements have included leading a Crowdfunding Roundtable in Washington, DC sponsored by the U.S. Small Business Administration Office of Advocacy, a panelist at the MIT Sloan School of Business 2014 Crowdfunding Roundtable, and a panelist at a national bar association event which included private practitioners, investor advocates and officials of NASAA. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation.