On November 16, 2015, Yirendai, an “online” Chinese marketplace lending platform, filed its Form F-1 (Form F-1 /A) with the SEC for an IPO listing on the NYSE. Yirendai is a subsidiary of CreditEase, a sizeable financial services firm in China that provides lending and wealth management services. Yirendai launched in 2012 and completed the restructuring to spin out from CreditEase in Q1 2015 in preparation for the IPO.

Taking a closer look at Yirendai’s amended prospectus filed on November 23, I raise a few questions about the business that the information in the filing do not fully address while providing some additional perspective on Yirendai as one of the many players in China’s internet finance market. Unless otherwise noted, all charts presented below are taken directly from Yirendai’s amended prospectus filed on November 23.

Larger loans are originated offline

On p. 15 under the “Risks Related to Our Business” section, Yirendai’s prospectus reads:

“In 2013, 2014 and the nine months ended September 30, 2015, 54.2%, 48.1% and 50.6% of our borrowers were acquired through referrals from CreditEase, respectively, contributing 61.9%, 59.8% and 67.8% of the total amount of loans facilitated through our marketplace, respectively.”

According to this information, historically, around half of borrowers are referred to Yirendai by its parent company CreditEase through its offline sales network. However, over 2/3 of the loan dollars in the first 3 quarters of 2015 went to offline borrowers, suggesting that the average loan size for borrowers acquired offline is double that for borrowers acquired through online channels. Why is that? Do online borrowers on average request lower loan amounts? Or does Yirendai have different restrictions on max loan amounts for borrowers depending on whether they are acquired through online or offline channels? If so, why are offline borrowers granted larger loan amounts?

According to this information, historically, around half of borrowers are referred to Yirendai by its parent company CreditEase through its offline sales network. However, over 2/3 of the loan dollars in the first 3 quarters of 2015 went to offline borrowers, suggesting that the average loan size for borrowers acquired offline is double that for borrowers acquired through online channels. Why is that? Do online borrowers on average request lower loan amounts? Or does Yirendai have different restrictions on max loan amounts for borrowers depending on whether they are acquired through online or offline channels? If so, why are offline borrowers granted larger loan amounts?

It may be that Yirendai is better able to evaluate and manage the risk of borrowers referred through CreditEase’s offline network and is therefore more comfortable with granting larger loans to this population. But as a company pitching itself as an online marketplace lender, the reliance on offline originations doesn’t quite fit this storyline. On p. 83 of its prospectus, Yirendai claims that they are attracting “a fast growing number of [their] borrowers through various online channels,” but the above historical figures suggest otherwise as borrowers and loans from offline channels have increased in proportion over the past 3 quarters.

Loans originated online have higher delinquency and charge-off rates

As I just mentioned, it may be that Yirendai is perhaps better able to evaluate and manage the credit risk of borrowers referred from offline channels. This appears to be true from the delinquency rates illustrated in the above chart taken from p. 86 of Yirendai’s prospectus. Loans originated in 2015 through online channels had much higher delinquency rates than those originated via offline channels.

Let’s take a look at Yirendai’s M3+ Net Charge Off Rate, which tracks loans of a certain vintage that are over 90 days delinquent, as illustrated in the below charts.

The conclusion appears to be the same. Comparing the data presented for the two origination channels beginning in Q1 2014, which is when loan volume grew to a meaningful scale, the M3+ Net Charge Off Rates are consistently higher for loans originated online by at least 1.5 times. The data seems to suggest that loans referred to Yirendai through offline channels perform better than those originated online. If this is the case, what is Yirendai’s strategy going forward? Will it continue to increase loan volume from offline channels, or will it improve its online origination methods and try to grow volume online? If Yirendai is unable to source better-performing loans from its online channels, not only does the online platform on which it has established its business come into question but it would also continue to be reliant on CreditEase for offline referrals, which leads to the issue of its relationship with CreditEase.

Relationship with CreditEase

CreditEase will remain Yirendai’s parent company and controlling shareholder after the potential IPO. The two entities have several contacts in place that put Yirendai firmly in the grips of the parent company. Looking at the Transitional Services Agreement between CreditEase and Yirendai, it appears that Yirendai is very reliant on CreditEase at the operational level as the latter will be providing almost all support services including management, administrative, legal, human resources, and financial. Over half of Yirendai’s operating costs can be attributed to the $49.0 million in fees paid to CreditEase in the first 3 quarters of 2015.

CreditEase will remain Yirendai’s parent company and controlling shareholder after the potential IPO. The two entities have several contacts in place that put Yirendai firmly in the grips of the parent company. Looking at the Transitional Services Agreement between CreditEase and Yirendai, it appears that Yirendai is very reliant on CreditEase at the operational level as the latter will be providing almost all support services including management, administrative, legal, human resources, and financial. Over half of Yirendai’s operating costs can be attributed to the $49.0 million in fees paid to CreditEase in the first 3 quarters of 2015.

The Cooperation Framework Agreement between the two entities highlights Yirendai’s even greater dependency on CreditEase. The agreement outlines that CreditEase will provide user acquisition and debt collections services as well as crucial tech support services, which include fund settlement and even product development. For borrower acquisition services, Yirendai will pay a fee of 5% of the loan amount to CreditEase, and this fee would increase to 6% for three years starting in 2016.

Given that Yirendai originates higher quality and greater loan volumes from CreditEase referrals, it seems both parties have more to gain from growing offline loan originations. Yirendai would continue to gain access to higher quality loan assets compared to its online originations, and CreditEase will earn even higher fee revenue from 2016 and beyond. So the question becomes, will Yirendai live up to its promise of being an online marketplace given its historical performance and relationship with CreditEase?

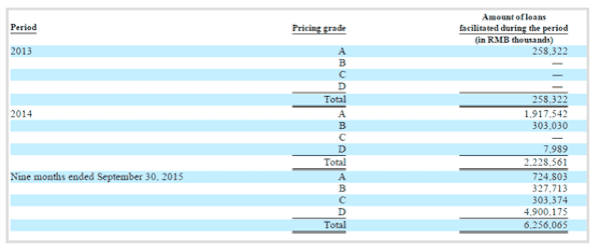

Growth driven by riskiest loans

Yirendai divides loans into 4 grades, from A to D, which is ranked from low to high risk with grade D representing the highest risk. Taken from p. 88 of its prospectus, below is a chart showing some interesting data on Yirendai’s loan grade mix.

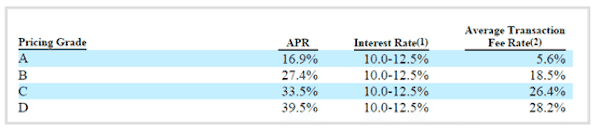

You see that RMB 4.9 billion, or 78%, of the RMB 6.3 billion in loans originated in the first 3 quarters of 2015 were the lowest-rated grade D loans. Now let’s take a look at the average fee rate charged for each loan grade, shown below in the chart taken from p. 134 of Yirendai’s prospectus.

Yirendai collects an average 28.2% in transaction fees for grade D loans from borrowers, which, according the prospectus, is collected in full upfront from borrowers acquired offline through CreditEase. Given the proportion of grade D loans and high corresponding transaction fee rates, it seems that Yirendai’s explosive growth in revenues and first-time turn to profitability in 2015 has been primarily driven by offline originations comprising of mostly grade D loans that contribute huge fee revenues.

CreditEase is also profiting from the 5% fees earned from these borrower referrals. In contrast, grade A loans comprised the majority of Yirendai’s originations in 2013 and 2014. The drastic increase in grade D loans as a proportion of Yirendai’s loan portfolio seems strange. The platform’s loan-grading methods could be seriously flawed or the firm may have been trying to boost profitability over the past year in preparation for the IPO. Regardless, Yirendai admits on p.88 of its prospectus that it has limited track record on grade D loans and present the following chart, which illustrates the charge off rates of grade D loans originated by CreditEase.

Since we can assume most of the grade D loans are sourced offline and will be serviced by CreditEase in accordance with the Cooperation Framework Agreement, it is highly likely that the Yirendai grade D loans will perform similarly. Contrasting this chart with the overall charge off rate for all loans from offline channels, the charge off rates for grade D loans are nearly double those for the 2014 Q2 and Q3 vintages. The resulting cost of the higher default rates will likely be borne by Yirendai’s risk reserve fund for compensating investors in default scenarios, which would significantly impact the company’s bottom line.

Comparing Against Peers

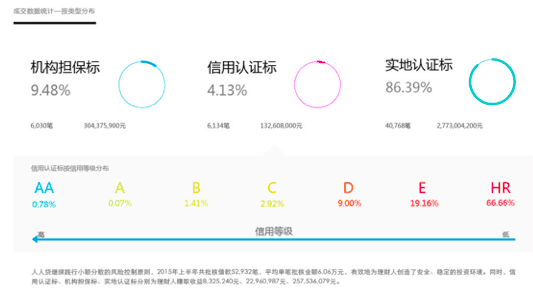

If we compare Yirendai to its peers in the Chinese marketplace lending space, the issues I’ve raised above may seem commonplace in the industry. Most of the larger successful lending platforms in China do rely heavily on offline originations, whether it be using the platform’s own on-the-ground network (e.g., Lufax or Renrendai) or working with third-party guarantee companies (e.g., Jimubox or Yooli) to source loans. If we examine Renrendai’s 2015 semi-annual report released on its www.we.com website, we can see the following data on its loan mix.

Approximately 86% of the loan amount sourced in the first half of 2015 are labeled as having completed “in-person verification”, and nearly 95% of the loans are rated D and below based on Renrendai’s 7-tier loan grade scale. Renrendai directs borrowers to an offline location managed by its sister company Ucredit (www.ucredit.com) to submit application materials for the loan as part of its “in-person verification” process. Ucredit essentially screens applicants as the first step of the process and will service the loans going forward, a similar relationship as the referral arrangement between Yirendai and CreditEase. With this in mind, it appears that Yirendai relies less on offline acquisition channels than Renrendai, and its loan mix seems slightly more diversified.

As it is a private company, Renrendai does not release delinquency and net charge off rates on its loans in the same detailed manner as Yirendai. The company has reported that it currently has about RMB 28.4 million in delinquent loans that are past due more than 90 days. It is also unclear what fees Renrendai pays to Ucredit for the loan originations and servicing.

Hints of Hypocrisy

As stated on p. 117 of its prospectus, Yirendai’s mission is “to provide consumers in China with easy access to affordable credit and investors with attractive investment opportunities through our online marketplace.” I don’t disagree with the latter half of this statement but question the part about providing affordable credit. Charging fees of 28.2% on average to the majority of its borrowers (grade D loans) is exceptionally high, especially when you consider that Yirendai is offering returns of 6.6%-11.25% to investors in the loans. The platform essentially collects the spread in the middle and lets borrowers bear the cost that is nowhere near “affordable.” If 28.2% is the average fee for grade D loans, what is the highest fee rate Yirendai has charged its borrowers? Yirendai’s practice of taking exorbitant amount of fees is also contrary to their claims of “fostering the sustainable growth of the industry” as high interest loans are rarely sustainable in any financial market.

As stated on p. 117 of its prospectus, Yirendai’s mission is “to provide consumers in China with easy access to affordable credit and investors with attractive investment opportunities through our online marketplace.” I don’t disagree with the latter half of this statement but question the part about providing affordable credit. Charging fees of 28.2% on average to the majority of its borrowers (grade D loans) is exceptionally high, especially when you consider that Yirendai is offering returns of 6.6%-11.25% to investors in the loans. The platform essentially collects the spread in the middle and lets borrowers bear the cost that is nowhere near “affordable.” If 28.2% is the average fee for grade D loans, what is the highest fee rate Yirendai has charged its borrowers? Yirendai’s practice of taking exorbitant amount of fees is also contrary to their claims of “fostering the sustainable growth of the industry” as high interest loans are rarely sustainable in any financial market.

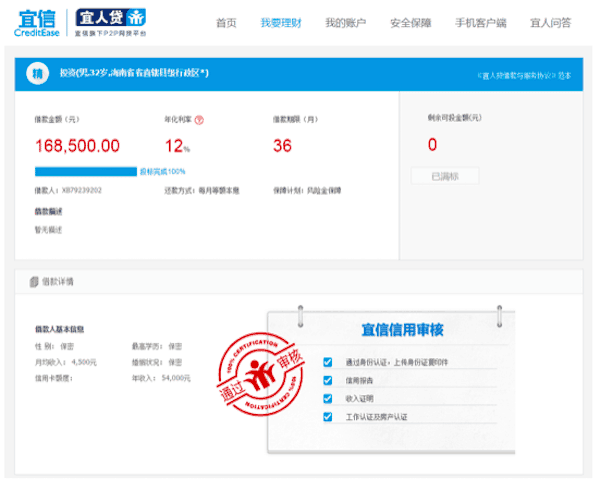

On the topic of fee disclosures, Yirendai states on p. 122 of the prospectus that one of their strategies is to “continue to define industry best practices” in areas including operational transparency. However, users browsing Yirendai’s website won’t be able to easily find the fees charged to borrowers and actual costs of the loans. In fact, the screenshot below contains all of the borrower information that Yirendai discloses on its website, which, even for those who can read Chinese, offers very little information.

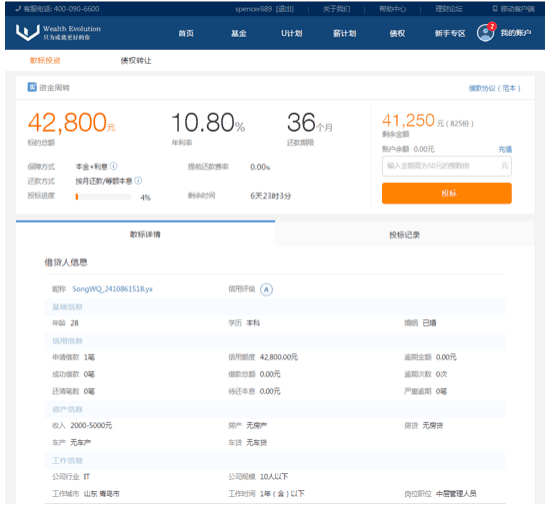

For a platform that upholds itself as an “information intermediary,” it appears that Yirendai shares very little information with retail investors. Investors can only see their expected return but do not have access to information that would allow them to determine the level of risk of a loan since the actual cost of the loan or even the loan grade is not presented to the investor. In my opinion, Yirendai and CreditEase can significantly improve its transparency with investors. By comparison, competing platforms such as Renrendai are much more transparent in disclosing borrower information and related fees as shown in the screenshot below.

Advice to Investors: Do Your Research

Advice to Investors: Do Your Research

In closing, I encourage those considering investing in Yirendai’s IPO to conduct detailed research on the company and the greater China online lending marketplace industry. Given the information and data presented in the prospectus, I believe the company has some issues it needs to address in terms of its origination methods and risk management. Keep in mind, CreditEase and Yirendai have the same management, and they are essentially the same company despite the spin-off restructuring. Therefore in addition to exploring the issues I’ve raised here, investors might consider taking a close look at CreditEase’s business and operations before drawing their own conclusions on the Yirendai opportunity.

Spencer Ang Li has served as Fincera’s Vice President of Product since June 2015 and as Chief Executive Officer for Fincera’s multiple product development subsidiaries since March 2014. Prior to joining Fincera, Mr. Li was an Investment Banking Analyst at Cogent Partners in New York, a sell-side advisor for private equity secondary transactions, from 2011 to 2014. During his tenure at Cogent, Mr. Li conducted fund due diligence, managed marketing processes, and participated in the sale and transfer of nearly $2 billion in limited partnership interests on behalf of public pensions, large regional banks, asset managers, and other financial institutions. Mr. Li received a BS in Economics and BA in Psychology from Duke University in 2011.

Spencer Ang Li has served as Fincera’s Vice President of Product since June 2015 and as Chief Executive Officer for Fincera’s multiple product development subsidiaries since March 2014. Prior to joining Fincera, Mr. Li was an Investment Banking Analyst at Cogent Partners in New York, a sell-side advisor for private equity secondary transactions, from 2011 to 2014. During his tenure at Cogent, Mr. Li conducted fund due diligence, managed marketing processes, and participated in the sale and transfer of nearly $2 billion in limited partnership interests on behalf of public pensions, large regional banks, asset managers, and other financial institutions. Mr. Li received a BS in Economics and BA in Psychology from Duke University in 2011.