New York based KLS Diversified Asset Management has agreed to invest £132 million in loans to small business originated via peer to peer lender Funding Circle. The loans will be from a private fund managed by KLS and will provide a “further injection of much needed funding into British small business sector”. KLS will invest across all risk bands.

New York based KLS Diversified Asset Management has agreed to invest £132 million in loans to small business originated via peer to peer lender Funding Circle. The loans will be from a private fund managed by KLS and will provide a “further injection of much needed funding into British small business sector”. KLS will invest across all risk bands.Samir Desai, CEO and co-founder of Funding Circle said;

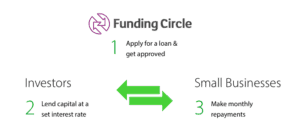

“Today’s news is another significant step on the journey to creating a global marketplace where creditworthy businesses borrow directly from a diverse range of investors. In the UK Funding Circle now has more than 35,000 individuals, the government-backed British Business Bank and other institutional lenders all helping businesses access the finance they need to grow.”

Gyan Sinha, Partner at KLS stated;

“KLS seeks out attractively valued fixed income investments across the world. Together with Funding Circle, we’re using technology to facilitate a cross-border transaction that would never have been possible as little as 5 years ago. It’s a unique marriage of cutting-edge technology and structured finance.”

Head of UK Capital Markets, Sachin Patel, commented;

“This landmark deal is a natural extension of our marketplace. It opens up investing to a range of larger institutional investors, from credit funds to pension funds and insurers, who are attracted to Funding Circle’s proven track record in facilitating loans with attractive yields and consistent credit performance”.

Funding Circle shares that businesses typically access the capital they need in 7 days compared to 15-20 weeks with a bank. UK businesses may borrow from £5000 to £1 million.

Funding Circle shares that businesses typically access the capital they need in 7 days compared to 15-20 weeks with a bank. UK businesses may borrow from £5000 to £1 million.