The International Organization of Securities Commissions (IOSCO) has released a working paper entitled Crowd-funding: An Infant Industry Growing Fast. It aims to provide a macro perspective of the global “financial return” or “FR” crowdfunding space. (Can we get a standardized taxonomy?!)

The International Organization of Securities Commissions (IOSCO) has released a working paper entitled Crowd-funding: An Infant Industry Growing Fast. It aims to provide a macro perspective of the global “financial return” or “FR” crowdfunding space. (Can we get a standardized taxonomy?!)

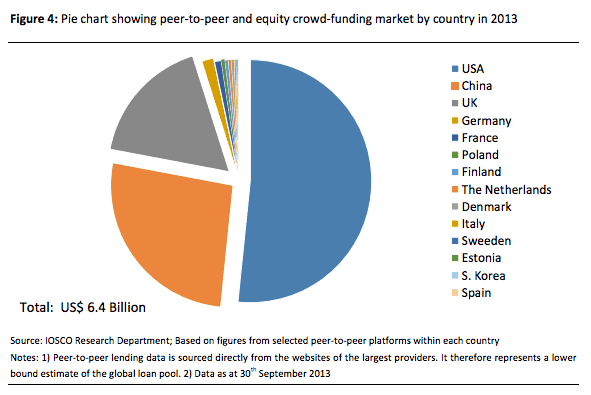

The main takeaway from the report is the size of the global crowdinvesting ecosystem. Based on self-reported data, the size of this industry has reached approximately $6.4 billion in 2013.

Another interesting data point from the report is the rate of default among global players in the peer-to-peer lending industry. Prosper leads the list of eight platforms with a 7.0% default rate while Zopa comes in lowest with a 0.2% rate of default.

Much of the growth in crowdinvesting is attributed to the peer-lending industry, which the IOSCO says has experienced 90% year-over-year growth.

The report concludes that investment crowdfunding “does not present a systemic risk to the global financial sector at present,” but leaves room for a retraction in the future depending on how the market reacts to key crowdfunding risks.

In another recent report, Nesta estimates that the UK alternative finance marketplace could hit £1.6 billion in 2014.