Decentralized finance (DeFi) emerged to challenge the inefficiencies and oftentimes lack of inclusivity of traditional finance (TradFi). In its earliest form, DeFi prized innovation over accountability, often prioritizing yield mechanics untethered to real economic activity. That era is ending. Today, tokenized real-world assets (RWAs) represent a path toward sustainable, transparent, and compliant finance – built on the best of both DeFi and TradFi.

RWAs – digital representations of off-chain assets like Treasuries, private credit, and real estate – are now at the heart of this convergence. They connect stablecoins and blockchain-native systems to real yield: returns derived from rents, interest payments, and contractual obligations rather than speculative tokenomics.

From Algorithmic Follies to Asset-Backed Yields

The push toward RWAs has been amplified by hard lessons from the programmatic yield era. In 2021, Terra’s Anchor protocol infamously promised ~20% APY on its algorithmic stablecoin UST – a yield with no real economy behind it. That experiment ended in carnage and the Terra/Luna collapse in 2022 starkly exposed the dangers of chasing yield that wasn’t backed by real assets or cash flows.

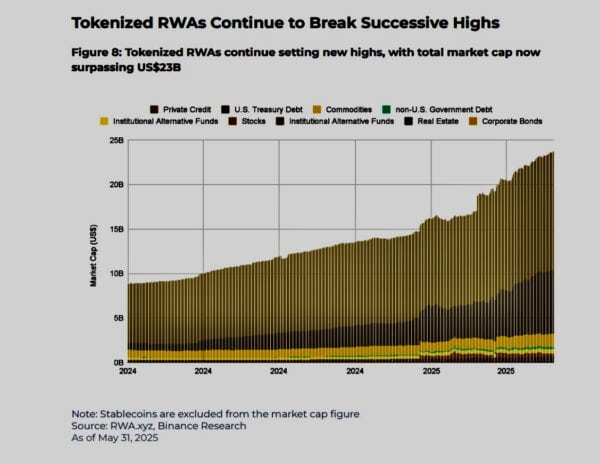

In contrast, many of today’s stablecoin yield opportunities are much more grounded. Platforms are using RWAs to generate stable, fixed-income-style returns, rather than relying on inflationary token emissions or Ponzi-like schemes. Tokenized Treasury products are a prime example. As investors hunted for safer returns amid crypto market slumps, the supply of tokenized U.S. Treasury assets on public blockchains soared nearly sixfold in a year, recently crossing $5 billion in market cap. In fact, these tokenized Treasuries have been growing far faster than traditional stablecoins, reflecting pent-up demand for yield that is actually earned (via interest on government bonds) rather than subsidized. Stablecoins themselves typically pay no interest to holders – their issuers, like Tether or Circle, invest reserves in T-bills and reap the benefits.

Now, thanks to tokenization, that paradigm is shifting. Traders and investors are finally demanding their share of the yield and getting it through instruments like on-chain T-bill funds. One report noted that as of early 2025, tokenized treasuries (roughly $4 billion then) were growing about “20× faster” than the broader stablecoin supply.

Regulated Rails and Compliant Growth

Global regulators are responding with frameworks that enable responsible innovation. In the EU, the Markets in Crypto-Assets (MiCA) regulation and the DLT Pilot Regime have laid the groundwork for asset-backed tokens to be issued, traded, and custodied within compliant structures. In the U.S., the SEC has approved multiple tokenized fund structures under existing exemptions, including stable-value products like YLDS.

This evolution is enabling a new category of fintech platforms, and we are proud to be a part of this cohort.

Tokenizing the Financial Ecosystem

Tokenization of traditional assets is progressing across sectors and regions. In addition to government debt and private credit, real estate is becoming a major frontier. In 2025, Dubai announced a government-supported initiative allowing fractional ownership of rental properties through tokenized shares. Investors can purchase exposure to local properties starting at ~$545 equivalent, with titles recorded on-chain and integrated with the official land registry.

Such efforts show that tokenization is not only about digitizing finance; it’s about transforming access. These assets become programmable, globally tradeable, and capable of yielding steady income with minimal intermediaries. RWAs make financial products available 24/7, support transparency via blockchain immutability, and introduce better fee structures through automation.

The Future of Finance On-Chain

The rise of tokenized real-world assets represents a pivotal evolution in the crypto and fintech landscape. By fusing the stability and yield of TradFi with the openness and innovation of DeFi, this trend is transforming stablecoins from mere digital dollars into productive assets. Stablecoin holders can now earn interest akin to a savings account or bond fund, without relying on unsustainable gimmicks. Investors large and small are gaining access to asset classes once beyond reach, whether that’s a slice of a Dubai skyscraper or a stake in a private credit fund, all through the ease of a digital token. The implications are profound: more inclusive finance, more efficient markets, and a more resilient ecosystem that’s tethered to real-world fundamentals.

Nick Motz is CIO of Soil, a Fintech platform providing institutional-grade and compliant fixed-income type yield generation on stablecoins.