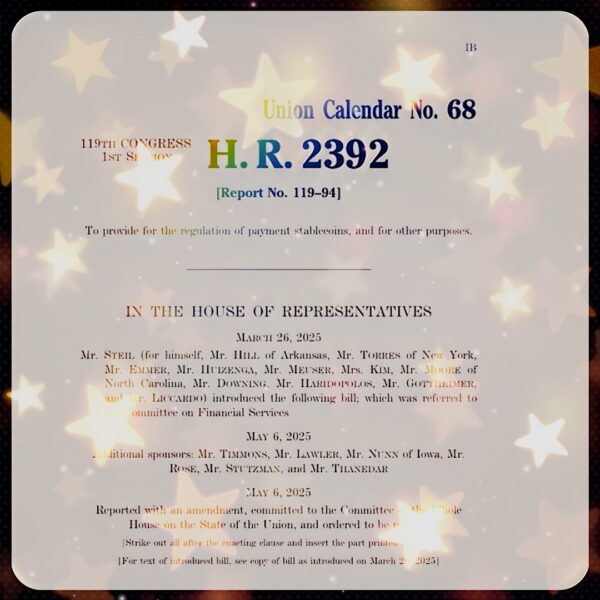

Federal oversight of stablecoins is forthcoming. Last month, the House Financial Services Committee reviewed the STABLE Act (HR 2392). Introduced by Chairman French Hill and Rep. Bryan Steil, the STABLE Act expands federal oversight of stablecoins by strengthening compliance mechanisms and providing clear rules for their issuance.

The Senate version of stablecoin legislation, the GENIUS Act (S. 394), was sponsored by Senator Bill Hagerty but has picked up several co-sponsors.

Both bills have bipartisan support.

Two years after the STABLE Act’s enactment, it becomes illegal for any custodial intermediary to offer or sell a payment stablecoin in the United States unless a permitted entity issued it. Foreign issuers must be subject to an applicable regulator in a nation with a regulatory regime that the Secretary of the Treasury determines is similar to the STABLE Act. That issuer must consent to be subject to reporting and examination requirements.

Each permitted user must maintain reserves backing its outstanding payment stablecoins on at least a one-to-one basis. Those reserves must consist of United States currency, including Federal Reserve notes, or money standing to the credit of an account with a Federal Reserve bank; funds held as demand deposits at insured depository institutions; treasury bills, notes, or bonds; repurchase agreements; or securities.

Rich Kerr, a partner at law firm K&L Gates, said the STABLE and GENIUS Acts aim to provide regulatory clarity in the United States while detailing how digital assets should operate. Kerr co-leads the firm’s financial services and digital assets, blockchain technology, and cryptocurrency industry groups.

“The consensus is that it needs to happen,” Kerr began.

Both acts are working their way through the government, with the House and Senate bills weaving their way through the labyrinth of legislative negotiations.

Kerr believes that whichever legislation is passed will look more like the STABLE Act. It doesn’t regulate all stablecoins, but it clearly defines a payment stablecoin. That is a digital asset used as a payment stablecoin relative to a national currency. It must be redeemable for a fixed amount of monetary value.

In the United States, that means any regulated stablecoin is backed by the U.S. dollar. Issuers must be approved, and there are strict reserve requirements. There are also annual audits, monthly reporting, and regular reserve disclosures. No interest can be paid on the coin, either.

“It brings a level of comfort,” Kerr said.

Recent efforts have clarified that payment stablecoins aren’t securities as defined by the Securities Act, and therefore aren’t subject to its regulations. States are also pre-empted from regulating them.

“That makes them similar to other securities in that regard,” Kerr said.

Will there be any pushback from states? Kerr said the STABLE Act has been around in various forms for five years, so they’ve had time to prepare. Still, many states indicated that they believe they have made progress in addressing stablecoins. They’ve put in the effort, and some feel Uncle Sam doesn’t have to get involved.

Will there be any pushback from states? Kerr said the STABLE Act has been around in various forms for five years, so they’ve had time to prepare. Still, many states indicated that they believe they have made progress in addressing stablecoins. They’ve put in the effort, and some feel Uncle Sam doesn’t have to get involved.

Kerr counters that federal legislation brings cross-country consistency.

He added that the STABLE Act protects market participants from suspect foreign issuers by requiring all issuers to be federally registered. That doesn’t exclude a foreign branch of a bank or a foreign-owned bank as long as it is approved.

Clarity is still needed on a few fronts. The bill requires that the United States Treasury enter into agreements with foreign jurisdictions and comparable regimes that facilitate international transactions. What those agreements will look like is unclear.

“The ability to engage in digital transactions and payments with the United States would be an important factor with other jurisdictions as they develop a regulatory regime,” Kerr said.

Issuers also have time to become compliant with the STABLE Act if they wish to continue issuing stablecoins.

“There is a grace period,” Kerr said. “If they’re already offering a coin, they’re not immediately defined as bad actors; they have two years to get on board.”

Kerr said a key point is that permitted stablecoins must be backed one-to-one by the US dollar. That spells trouble for algorithmic stablecoins not backed by the greenback. Tether is one.

That dollar backing brings safety, Kerr concluded.

“(Such coins) will be the safest versions out there,” he said. “If there’s a dollar-backed USD coin, why use one that’s not dollar-backed?”