Occasionally, a Fintech comes along that is truly unique, and Waterlily is one such company. From the problem it tackles to how it tackles it, Waterlily has identified a new (and large) territory with little competition. It serves its clients in a logical, methodical way.

Waterlily uses artificial intelligence to predict long-term care needs decades before they arise. Used by financial advisors to guide clients through planning for such care, the platform leverages more than 500 million data points to compare a client’s future needs against the actual experiences of those most like them.

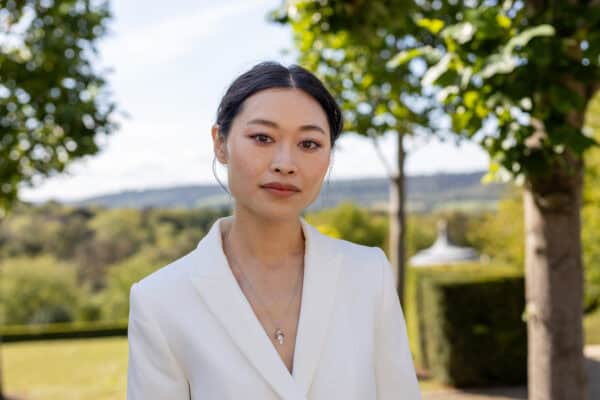

Co-founder and CEO Lily Vittayarukskul’s personal experience with a loved one’s care helped shape Waterlily. When an aunt was diagnosed with cancer, there was no plan. The family had to quickly make many important and expensive decisions under stress. Some relationships aren’t the same a decade later.

Waterlily’s deeply considered approach focuses on advisors

Vittayarukskul said few realize that health insurance and Medicare don’t fully cover long-term care. That leaves millions unprepared for the inevitable. With inflation, the assumed cost of care for a 30-year-old in 2025 could more than triple by the time it’s needed.

Socking some spare change in a bank account won’t cut it; a detailed investment strategy is needed. Who are people most likely to discuss financial matters with? Advisors. So, Waterlily focused on giving them tools to help them help their clients.

However, Vittayarukskul and co-founder Evan Ehrenberg realized that long-term planning discussions between advisors and clients are difficult. They needed a way to make it easier.

“We found that it was a particularly good use case for predictive AI,” she said. “How do you make it relevant to the client sitting in front of you? How do you gather all the right data sets so that you can have an accurate view as best as you can?”

“We also need to build a beautiful user interface that takes all the hypotheticals of long-term care and flattens them into a single linear flow for a client that goes next to next to next to next. And how do you make it “non-salesy”? Because that was really important to me. You focus on the needs, not the solutions.”

How the process works

The process begins with a client answering questions about health and family history for three minutes. They discuss their desires, such as how long they want to remain in their home and how much family support they have.

Then, the AI gets to work. It provides probabilities of needing different levels of care and for how long. That care is priced out based on the cost of local options.

Family contributions are also factored in. If someone wishes to stay in their home but is highly likely to need assistance, the model estimates how many hours per week, and for how long, each member must contribute for the plan to succeed. If some cannot commit, revisions are entered with new costs produced.

“The interesting thing is we’re not selling them on a higher cost,” Vittayarukskul said. “The client has designed that higher cost for themselves.”

The result is an overall personalized care plan incorporating financial data, insurance coverage, and healthcare trends to protect family savings. Waterlily’s clients include financial advisors, insurance carriers, insurance distributors, and independent insurance agents.

Waterlily’s knowledgeable investor base

A scan of Waterlily’s investors shows those industries are putting their money behind it. The list includes Nationwide, Edward Jones, former GE Insurance and Transamerica LTC CEO Tim Kneeland, and Insight Partners managing director of healthcare Scott Barclay. In late January, Waterlily raised a $7 million seed round, and had previously raised a $2.2 million pre-seed. Since its launch only 13 months ago, the company has secured contracts with Prudential, Financial Independence Group, and two additional Fortune 100 carriers.

“Who we attracted were the investors who already understood the nuances of our space and who are trying to help us activate that,” Vittayarukskul said, adding that complexity has its advantages. “One of my angel investors, Charlie Songhurst, said that whenever he sees a founder that’s trying to work in a very complex space, that is a huge moat within itself; it’s not easy to copy.”

Vittayarukskul returned to the importance of making those advisor-client discussions as simple and stress-free as possible. Even insurance policies, with their dozens of pages of disclaimers and conditions, can be analyzed, compared and simplified.

Set the input, discuss the outputs. Alter if necessary. Then, it becomes more of a straightforward chat like other financial matters.

“What we’re trying to, at its core, is to save these families at least hundreds of thousands of dollars on what this event is going to cost,” Vittayarukskul said. “It serves the overall economy around how we sustainably age as a population, and how do we control that cost sustainably for families that either pay out of pocket or the insurance industry that’s trying to figure it out?”

Vittayarukskul sees a more digitally transparent generation as being more open to these difficult conversations. Make them easier, and more will be had.

“There’s more space to talk about it,” she said. “I think the Gen Xers are way more inclined to plan for this event than the Baby Boomers or the Silent Generation. (In the past) It was assumed, ‘You’re going to come back and move in with me; we’re going to take care of each other.”

“We don’t have that structure anymore.”