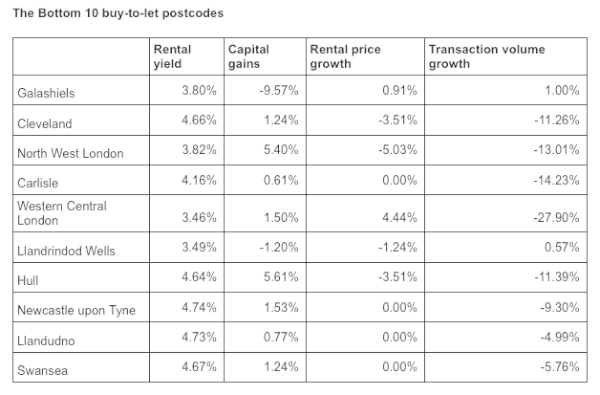

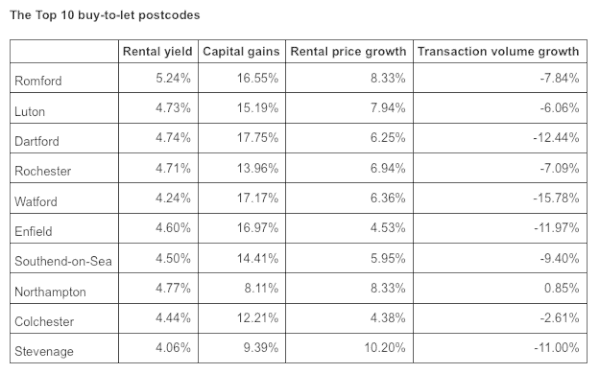

LendInvest, the UK online property lending and investing business, has released its latest quarterly research Index on the UK Buy-To-Let market. The LendInvest BTL Index ranks each postcode area around England and Wales based on a combination of four critical metrics: capital value growth, transaction volumes, rental yield and rental price growth.

“Consistency is clear here: suburban parts of the South East of England continue to offer the best opportunities for investors, while Inner London continues to underperform. The absence of a large shake-up in the Top 10 buy-to-let postcodes this quarter shows some stability in the market following a year of market-moving uncertainty and geopolitical shocks. This can only be good news for property professionals: there is nothing to wait for to start investing, renovating and building,” clarified LendInvest Co-Founder and CEO Christian Faes. “Landlords and investors must remember that considering rental yield isn’t enough; it’s critical to find a property that impresses across all metrics. In the quarter ahead, we’ll be watching closely a number of areas that could edge towards the Top 10, like Bristol (ranked #15), Milton Keynes (#16) and Manchester (#21).”

Key findings for February 2017:

- Romford in East London takes top spot, climbing six places thanks to an 8% leap in rental price growth

- Northampton remains the only postcode in Top 10 to be located outside the South East

- Stevenage was ranked tenth overall despite recording the highest rental price growth at 10.20%

“Consistency is clear here: suburban parts of the South East of England continue to offer the best opportunities for investors, while Inner London continues to underperform. The absence of a large shake-up in the Top 10 buy-to-let postcodes this quarter shows some stability in the market following a year of market-moving uncertainty and geopolitical shocks. This can only be good news for property professionals: there is nothing to wait for to start investing, renovating and building,” clarified LendInvest Co-Founder and CEO

“Consistency is clear here: suburban parts of the South East of England continue to offer the best opportunities for investors, while Inner London continues to underperform. The absence of a large shake-up in the Top 10 buy-to-let postcodes this quarter shows some stability in the market following a year of market-moving uncertainty and geopolitical shocks. This can only be good news for property professionals: there is nothing to wait for to start investing, renovating and building,” clarified LendInvest Co-Founder and CEO