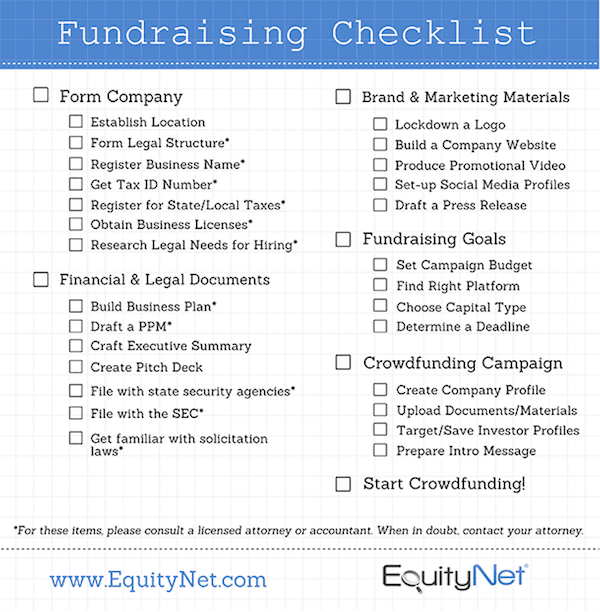

This week, crowdfunding platform EquityNet unveiled a new equity crowdfunding checklist that will help businesses find success with their upcoming campaigns.

The following was reported by EquityNet.

The following was reported by EquityNet.

The company is legally formed – in this instance; the platform used an LLC as an example:

- Choose a name for your LLC

- Can’t be the same name as another on file with LLC office

- Must end with an LLC designator

- Can’t include certain words prohibited by the state (Bank, Insurance, Corporation, City, etc.)

File Articles of Organization with state’s LLC filing office

- Note Filing Fees, Required Information, and Registered Agent

Create an LLC Operating Agreement

Members’ percentage interests in the business

Members’ percentage interests in the business- Members’ rights and responsibilities

- Members’ voting power

- Allocation of profits/losses

- How the LLC will be managed

- Rules for holding meetings and taking votes

- Buy/sell provisions that determine what happens if a member wants to sell his interest, dies, or becomes disabled

Publish a Notice stating intention to form LLC (some states only)

Get licenses and permits needed to operate (business license, Federal EIN, sellers’ permit, zoning permit, etc.). When a team is in place, the company must do the following:

- Determine basic functions of company

- Assign people to handle those functions

When the company has an MVP or service, it must identify customer base:

Prepare financial/legal documents

Consider hiring an outside accountant and lawyer

- The money spent will provide you with objective third-party professional guidance

- Will help prevent future legal problems

Business Plan – Describe the following:

Business Plan – Describe the following:

- Business Summary (Executive Summary)

- Business model

- Product/Service

- Any intellectual property

- Markets

- Competition

- Management

- Finances

- Capitalization Strategy

Executive summary

- Purpose/Importance – explain your business in a way that will want people to learn more. It should include enough information so investors can see the potential behind it without having to read the whole plan

Pitch deck

- Purpose/Importance – A presentation to provide potential investors with a brief overview of business plan usually used during face-to-face or online meetings with potential investors, customers, partners, and co-founders.

PPM

Purpose/Importance – A legal document that states the objectives, risks, and terms of an investment involved with a private placement. It provides buyers with information on the offering and protects the sellers from the liability associated with selling unregistered securities.

Purpose/Importance – A legal document that states the objectives, risks, and terms of an investment involved with a private placement. It provides buyers with information on the offering and protects the sellers from the liability associated with selling unregistered securities.- Difference from Business plan – A business plan is primarily a marketing document created to promote a company and purposely contains forward-looking information. A PPM is a disclosure document that is descriptive but not persuasive and allows the investor to decide on the merits of the investment – it’s more factual and concrete. It can serve as a marketing tool if it is well drafted.

File with State Security Agencies

- Purpose/Importance – There are numerous regulations surrounding a securities offering on both a state and federal level. In order to adhere to this regulation a company must file appropriately with the relevant State Security Agencies. Please consult an attorney in regards to this.

File with the SEC

- Purpose/Importance – There are numerous regulations surrounding a securities offering on both a state and federal level. In order to adhere to this regulation, a company must file appropriately with the relevant State Security Agencies. Please consult an attorney in regards to this.

Get familiar with Solicitation Laws

Prepare Marketing/Brand materials

Consider hiring an outside PR firm – if the company does:

- Know the business objectives (where you’re going)

- Determine if they need access to a larger network than your existing one

Website

- Allows customers and potential investors to quickly learn more about your company

- Helps establish web presence

- Helps establish social proof

Video

- Campaigns that have video are 4x more likely to receive investor attention

- Keep it short (3 minutes max)

Expand social media presence

- Increases brand recognition/authority

- Helps establish web presence

- Helps establish social proof

Testimonials

- Gives investors opportunity to hear what customers think about product

Product/Service demonstration

Elevator pitch – verbal version of executive summary

Determine fundraising goals

Which platform to use

- Mass market v. vertical

- Tools/services provided by platform

- Size of platform

Research past campaigns similar to the company’s

- Look for both successful and unsuccessful examples

- Find elements that can suit their campaign

How much to spend with platform

- Determine the level of service the company wants to receive

What type of capital to go for (equity, debt, etc.)

- Evaluate the merits of various forms of capital

Establish a realistic minimum funding goal

Establish a realistic funding deadline

Determine what funds raised will be used for

Finalize preparations for campaign

- Create a profile on a crowdfunding platform

- Target investors with expressed interests first

- Prepare introductory materials/pitch text

- Upload appropriate documents and marketing materials (business plan, pitch deck, video, etc.)

See the entire checklist below.