KPMG UK and Blue J to Launch Generative AI Tool to Address Tax Research Questions

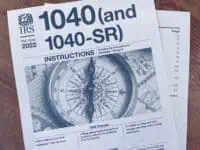

KPMG UK and Blue J announced that they will launch a new generative AI powered product to answer challenging tax research questions in seconds. KPMG will have exclusive access “to the tool, Ask Blue J, among the big four accountancy firms in the UK for… Read More

Read more in: Artificial Intelligence, Fintech, Global | Tagged benjamin alarie, blue j, europe, kpmg, stuart tait, taxes, uk, united kingdom