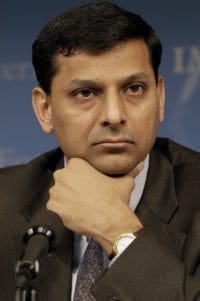

Payments Council of India Welcomes RBI’s Move to Permit Approved Non Bank Payment Providers to Participate in Centralized Payment Systems

Welcoming the Reserve Bank of India’s (RBI) move to permit authorized or approved non-bank payment system providers to take part in centralized payment systems (CPS), the Payments Council of India (PCI), the nation’s largest industry body for the non-banking digital payments ecosystem, has confirmed that… Read More

Read more in: Fintech, Asia, General News, Politics, Legal & Regulation | Tagged digital payments, digital transactions, financial inclusion, iamai, india, internet and mobile association of india, payments, payments council of india, rbi, reserve bank of india, virtual payments