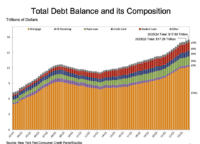

Household Debt Tops $17.5 Trillion, Credit Cards at Whopping $1.13 Trillion

The debt train keeps on running. A New York Fed report published today shares that total household debt has now topped $17.5 trillion as of Q4 2023. If you compare it to the same quarter in 2022, when total debt stood at $16.9 trillion, this… Read More

Read more in: General News, Opinion | Tagged debt, household debt, new york federal reserve, us federal reserve, Wilbert van der Klaauw