IW Capital Research: UK Investors Mixed on Brexit’s Impact on Their Financial Strategy

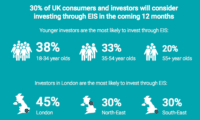

IW Capital has published research on UK investor sentiment regarding Brexit and the impact of Article 50. Surveying 1000 investors who have between £10,000 and over £250,000 worth of investments, IW Capital says that a significant number of investors are willing to shoulder greater risk in… Read More

Read more in: General News, Global | Tagged brexit, iw capital, luke davis, research, uk, united kingdom