Digital Assets: INX Token Initial Public Offering Said to be Approved

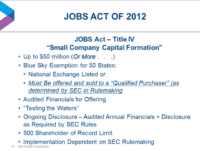

In August of 2019, INX Limited filed a registration statement (Form F-1) for an initial public offering (IPO) offering 130,000,000 INX Tokens, and ERC20 compliant digital security. In the preliminary prospectus, each INX Token is said to entitle its holder to an annual pro-rata distribution… Read More

Read more in: Blockchain & Digital Assets, Offerings | Tagged david weild, digital assets, gibraltar, initial public offering, INX, ipo