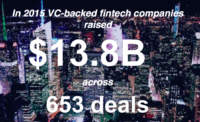

$13.8B for Global Funding for VC-Backed Fintech Firms; Payments, Lending & Blockchain Lead Way

2015 was the year that financial technology entered the mainstream, claims the new report “Pulse of Fintech” from KPMG and CB Insights (see also the University of Cambridge Centre for Alternative Finance seminal benchmarking surveys last year), which estimates that VC-backed fintech firms around the world secured $13.8 billion in… Read More

Read more in: Asia, General News, Global, Investment Platforms and Marketplaces | Tagged 500 startups, accel partners, andreessen horowitz, balderton capital, blockchain, centre for alternative finance, citigroup, funding circle, goldman sachs, google ventures, gusto, index ventures, one97, oscar, sv angel, vc, worldremit