Basel Committee to Consult on Targeted Revisions to Standards on Crypto-Asset and Interest Rate Risk

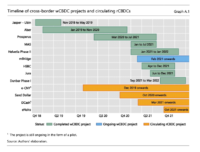

The Basel Committee on Banking Supervision met virtually on 5 and 7 December to discuss a range of policy and supervisory initiatives. The Committee took stock of its review of various elements of “the prudential standard for banks’ exposures to crypto-assets published in December 2022.”… Read More

Read more in: Global, Blockchain & Digital Assets, Fintech, Politics, Legal & Regulation | Tagged basel committee, bis, climate action, crypto-assets, financial services, research, Research Study, update