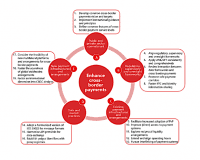

Bank of England Speech Notes that Cross Border – Faster Payments May Include DLT

A speech delivered today by Victoria Cleland, Executive Director, Banking, Payments, and Innovation at the Bank of England, tackled the topic of faster payments and cross-border transfers. Cleland highlighted the three-stage process to advance cross border payments being pursued at the international level and then… Read More

Read more in: Blockchain & Digital Assets, Global, Politics, Legal & Regulation | Tagged bank of england, cbdc, payments, transfers, uk, united kingdom, victoria cleland