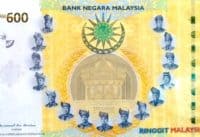

Malaysian Fintech MyMy Given Conditional Approval from Bank Negara as Company Prepares for Digital Wallet Launch

MyMy revealed on Monday (April 26, 2021) that it has obtained conditional approval for a large scheme E-money license from Bank Negara Malaysia, the nation’s central bank. The Fintech firm is now planning to launch its digital wallet services in the coming year. Until all… Read More

Read more in: Asia, Fintech | Tagged asean, bank negara, digital banking, digital wallet, malaysia, mymy, online wallets, sharia-compliant, southeast asia