Online lending platform Lendio recently announced it has facilitated more than 213,000 Paycheck Protection Program (PPP) loan approvals, totaling $9.8 billion. According to Lendio, the PPP re-opened in January 2021 with new rules implemented by Congress intended to equitize access to relief funding for minority-owned businesses and very small businesses.

As previously reported, the PPP is part of the $2 trillion CARES Act signed on March 27, 2020, aimed at getting small business owners back on their feet and millions of Americans back to work following the COVID-19 pandemic. The first round of the program quickly closed and the U.S. Senate passed $484 billion in new pandemic relief funds to provide additional funding to the PPP small business aid program, pay for coronavirus testing, and help hospitals deluged by sick patients during the COVID-19 pandemic. Lendio notably facilitated $8 billion in Paycheck Protection Program (PPP) loans for 100,000 small businesses during the first program. The lender’s 2021 key findings include:

As previously reported, the PPP is part of the $2 trillion CARES Act signed on March 27, 2020, aimed at getting small business owners back on their feet and millions of Americans back to work following the COVID-19 pandemic. The first round of the program quickly closed and the U.S. Senate passed $484 billion in new pandemic relief funds to provide additional funding to the PPP small business aid program, pay for coronavirus testing, and help hospitals deluged by sick patients during the COVID-19 pandemic. Lendio notably facilitated $8 billion in Paycheck Protection Program (PPP) loans for 100,000 small businesses during the first program. The lender’s 2021 key findings include:

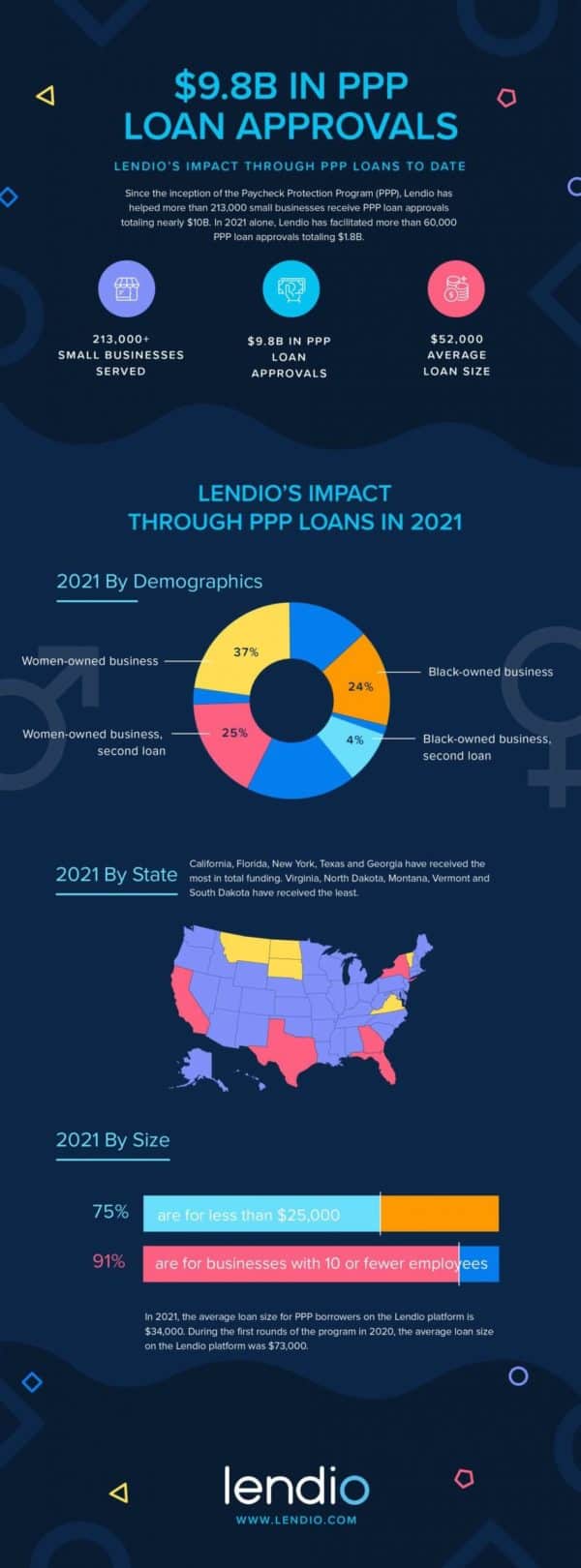

- Lendio has helped more than 60,000 small businesses receive more than $1.8 billion in PPP loan approvals in the latest round, with thousands of applications still being processed daily.

- 75% of funded loans are for amounts lower than $25,000, with an average loan size of $34,000 for all borrowers.

- 91% of loans have gone to businesses with ten or fewer employees.

- Of those who chose to identify gender, 37% of first-draw borrowers in this round are women. Only 25% of second-draw borrowers in this round are women, indicating that women were less likely to receive first draw PPP loans in earlier rounds of the program.

- Likewise, 24% of first draw loans went to Black business owners. Only 4% of second draw loans went to Black business owners, indicating that Black business owners were less likely to receive first draw PPP loans in earlier rounds of the program.

- When it comes to loan distribution by state, California, Florida, New York, Texas and Georgia have received the most in total funding so far this year. Virginia, North Dakota, Montana, Vermont and South Dakota have received the least in total funding.

Brock Blake, CEO and Co-Founder of Lendio, spoke about the latest milestone by stating:

“Lendio’s mission has always been to ‘fuel the American dream’ for small business owners. In such a turbulent time for businesses across the country, Lendio has pivoted to saving the American dream. It’s been an honor to be able to support so many of the nation’s most important businesses, and we’re not done yet. We are committed to continuing to do everything in our power to provide support in the form of relief funds and other types of capital to help businesses recover and grow.”