Following a call for input on the consumer investment market that closed to comments last month, the UK Financial Conduct Authority has issued a report on how the regulator “works to protect consumers from investment harm” citing activity during the first 10 months of 2020.

Following a call for input on the consumer investment market that closed to comments last month, the UK Financial Conduct Authority has issued a report on how the regulator “works to protect consumers from investment harm” citing activity during the first 10 months of 2020.

In a release, Sheldon Mills, Executive Director, Consumers and Competition, stated:

“The UK has one of the world’s leading financial services industries, offering consumers access to a wide range of investment products. In some areas, however, the consumer investment market is not working as well as it should, and too often consumers are offered unsuitable products or advice. Protecting consumers and ensuring they have confidence in the suitability of advice they receive is a key priority for the FCA and today’s report highlights some of the work we are undertaking to achieve this.”

Mills added that incorrect or out of date permissions can increase the harm to consumers:

“This is why we’re today calling on firms to review their permissions and ensure they reflect current business models. We will take action where we consider out of date permissions may cause harm to consumers. The message is clear, use it or lose it.”

The FCA said it is launching the next phase of its “ScamSmart Investment campaign” that seeks to warn consumers of the “increased threat of clone investment fraud, alerting them to the key warning signs and driving investors to the FCA’s warning list of firms to avoid and the FCA register of authorised firms.”

A portion of the FCA’s website outlines the “Consumer Investments Data Review 2020,” including a list of higher-risk investments” as follows:

- Mini-bonds (also known as high interest returning bonds) and other non-readily realisable securities

- Unregulated collective investment schemes (UCIS)

- Some structured products, derivatives and Contracts for Difference (CFDs)

- Venture Capital Trusts (VCTs)

- Exchange tokens or cryptocurrencies (IE Bitcoin)

- Investment-based crowdfunding

- Peer-to-peer lending

The FCA cautions retail investors to better understand affiliated risk and to ask themselves if they can afford to lose an entire investment.

In 2020, the FCA reports that approximately 110,000 people visited the ScamSmart website with over 21,000 people checking an investment or pensions opportunity. Many of the problems are with unauthorized or scam firms pitching fraudulent offers.

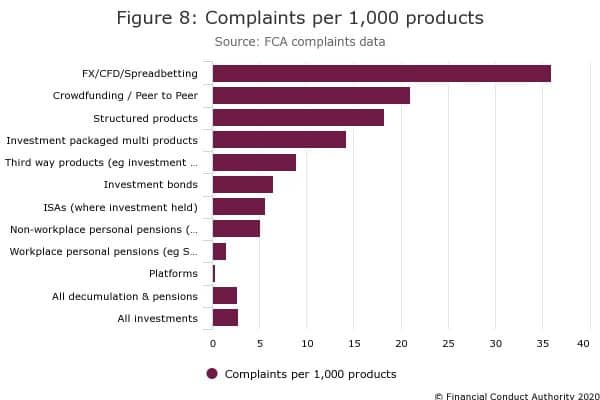

Regarding complaints pertaining to crowdfunding and P2P lending, the number of complaints per thousand is relatively high at over 20 complaints per 1000 products. Of course, without detailed data, it is difficult to understand any nuance behind the data.

Members of the investment crowdfunding industry have expressed their concern that excessive regulatory action could undermine the UK’s robust investment crowdfunding sector – an important aspect of the UK Fintech industry.

The FCA is currently reviewing the comments received on Consumer Investors with a report to follow later this year. The regulator says that reducing harm in the Consumer Investment market was identified as a business priority for the next 3 years in the FCA’s 2020/21 Business Plan and will continue to be of major focus.