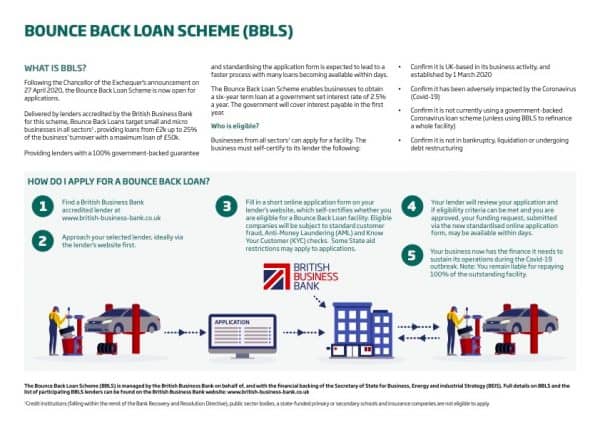

Bounce Back Loans, the new COVID-19 support programming targeting the smallest of firms is open for applications today with funds expected to be distributed within days. Information on the program is available now on the British Business Bank website.

Also included on the British Business Bank site, is the list of approved lenders. While all well-known names – not a single Fintech was amongst the first batch of approved lenders.

Currently, the following banks are approved to issue the government-backed loans:

- RBS

- HSBC

- Bank of Scotland

- Lloyds Bank

- Natwest

- Santander

- Danske Bank

- Ulster Bank

- Clydesdale and Yorkshire Banks

More lenders are expected to follow shortly.

One Fintech that is anticipated to be on the list soon is Starling Bank. In a blog post last week, Starling stated:

“As an accredited CBILS lender, Starling is going to be offering loans under the Bounce Back scheme. We’ll be publishing more details and a way to register for this scheme soon. Starling Bounce Back loans will be available as soon as possible after 4 May.”

Starling has also posted a page where small businesses may register their interest in receiving a Bounce Back Loan.

Other Fintechs that are already participating in the Coronavirus Business Interruption Loan Scheme (CBILS), may soon be added to the list of approved lenders.

Under the Bounce Back Loan scheme, borrowers mar receive a loan of up to £50,000 and pay no principle nor interest for 12 months. After this initial period, a 2.5% annual interest rate will be applied. The loans are backed 100% by a UK government guarantee and thus represent little risk for lenders.