This week, the SEC Small Business Capital Formation Advisory Committee met at the Commission to discuss access to capital around the country. Multiple presentations were delivered on the state of access to capital including one by the Office of the Advocate for Small Business as well as a comparative point of view from data provider Pitchbook. An interesting perspective was shared as the capital markets have changed dramatically in recent years. The two aforementioned presentations showed that the number of public companies has continued to decline while the private capital markets have boomed.

The changing dynamics of capital markets have been covered repeatedly in this publication and many others, but the data provided at the meeting is worth reviewing. The US economy is fueled by smaller firms in need of growth capital. The easier the access the faster the growth. Of course, not all companies are successful but it is the constant churn of innovation driven by entrepreneurship that has engendered the most successful economy in the world as well as the wealthiest nation. Policy at the regulatory level is vitally important to sustain this success.

According to the Advocate’s report, private exemptions are raising enormous sums with the majority being generated by Reg D 506b. Specifically, from July 1, 2018 to June 30, 2019, funds raised by the various securities exemptions include:

- Reg D 506b – $1.4 trillion

- Reg D 506c – $210 billion

- Rule 504 – $260 million

- Reg A+ – $800 million

- Reg CF – $54 million

- IPOs – $50 billion

- Other registered offerings including secondary offerings – $1.2 trillion

As one may expect, Reg D is dominated by two states; California (6937 offerings) and New York (7659 offerings).

At the other end of the spectrum, the smallest securities exemption – Reg CF, California and New York dominate as well with 85 and 44 offerings respectively.

Meanwhile, the number of publicly traded firms have tanked as private offerings have increased in importance and activity. Younger firms want to stay private longer due to the cost of going public as well as the ocean of private capital that is available to these firms.

In 1996, there were 8090 publicly listed firms. In 2018, that number was a bit more than half at 4,397. The market cap of these listed companies did rise to record levels at over $30 trillion but this number was dominated by a handful of some very popular names we pretty much all know. Public markets have become dominated by the biggest firms.

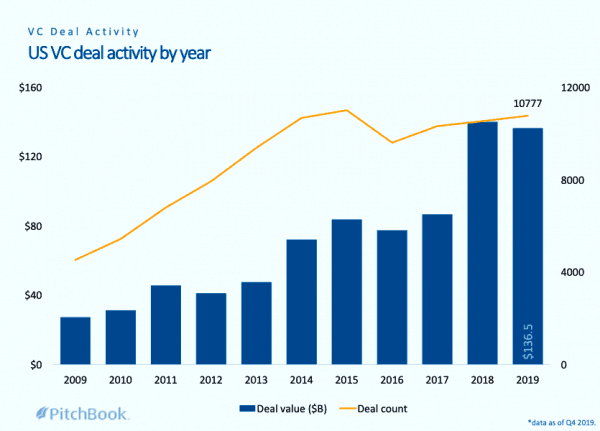

Meanwhile, venture capital and angel investing has pushed into record territory.

According to Pitchbook, in 2019 10,777 deals raised $136.5 billion. Ten years before in 2009, those numbers were just a fraction of that amount.

Deal size has jumped as well. Today, the average seed-stage round stands at $2.1 million with a pre-money valuation of $8 million.

Comparatively, an early-stage deal in 2009 averaged $3 million at a pre-money valuation of $8.3 million. In 2019, an early stage round averaged $6.5 million at a pre-money valuation of $29.4 million.

In recent years, IPOs have accounted for most of the capital exited from VC backed firms but these same public offerings represent just 10% of VC exits as most companies are sold to a strategic or financial investor. In brief, an IPO has become an exit not an entry point for big money.

Companies are staying private longer while raising more money before they even consider a public offering. The median amount raised before an IPO in 2019 (as of October) stood at $160.4 million. Meanwhile, these same companies are raising less money in these same IPOs relative to their valuation.

So who are the winners in this environment? And who gets the short end of the deal?

Well, professional VCs seem to be doing just fine. But smaller investors are being cut out of the wealth equation while capital access is still being concentrated in just a handful of markets and thus a smaller population of firms. While high profile VCs capture a lot of digital ink, today most early-stage ventures are bootstrapped as founders tap into their own savings to launch a new business.

To quote the Advocate’s office, “businesses in rural areas are … generally raising less capital,” as locales like Silicon Valley & Alley rock. Underserved communities also include women and minority communities that continue to struggle to attract attention and funding. So the need is recognized, the question is the fix.

Currently, the SEC is in the midst of a concept release, a review of the current ecosystem of securities exemptions – how they can be harmonized and how they can be improved.

One of the most glaring items is the current definition of an accredited investor that is based on a wealth metric: $200,000 a year in salary or a net worth of $1 million minus your primary residence; if you are married – the salary requirement jumps to $300,000 a year. The wealth metric should be abolished as it leaves too many unsophisticated people at peril while disenfranchising investors that can comprehend risk. As mentioned above, you must be accredited to participate in Reg D offerings – the most popular exemption utilized by private firms.

The Commission’s proposal on the table keeps the wealth metrics but adds some additional paths to be recognized as accredited. These new paths are not completely defined and may fall short. What the definition needs, is an online test for an investor to be qualified as sophisticated. Simple and direct.

In general, access to capital needs to be improved by removing artificial barriers (like an arbitrary funding cap on Reg CF), by enabling technology – not constraining it to an extreme. Of course, appropriate protections must be in place – something the Commission is keenly focused on.

The Office of the Advocate has a series of recommendations to improve the ecosystem, including:

- Additional qualifying pathways to individuals being accredited based upon sophistication in making investment decisions could include:

- financial professionals licensed by or registered with the SEC, state securities regulators, or appropriate self-regulatory organizations (e.g., FINRA); and

- attainment of designated financial industry examinations or licenses.

- Retail Investor Access to Pooled Vehicles of private securities

- A clear finders framework (individuals acting as matchmakers for companies seeking funding)

- Fixing Reg CF

- Remove the funding Cap (did not define an amount but some industry participants have asked for a $20 million cap)

- Allow accredited investors to invest as much as they want

- Enable Special Purpose Vehicles

- Update compensation for crowdfunding platforms

- Scaled reporting requirements for smaller firms

Many of these shortcomings have been apparent for years. The discussion about finders has been going on for a decade or longer. A solution is long overdue.

As with most things, the devil is in the details and it is unclear as to how far the Commission will go in addressing these challenges. At a minimum, it is good to know the Commission recognizes the problem and this is due, in part, to the new office of the Advocate for Small Business Capital Formation. Let’s hope the initiative is successful.

The two presentations from the SEC Small Business Capital Formation Advisory Committee meeting are available below.

The SEC Office the Advocate’s first annual report is available here.